Are Institutions Rethinking Their ESG Commitments?

Friday 13 February 2026Some financial institutions are stepping back from formal ESG and net-zero commitments in response to political, regulatory, and commercial pressures, raising questions about how ESG priorities are interpreted and applied.

Read moreWhat does the new SEND funding settlement mean for council borrowing?

Wednesday 11 February 2026Central government’s decision to fund 90% of councils’ cumulative SEND deficits provides major relief to local authorities, which have faced rising demand, growing borrowing needs, and accounting pressures due to statutory SEND duties and insufficient funding. The grant will significantly reduce borrowing projections for many councils, though concerns remain about how future SEND costs will be sustainably funded.

Read moreIs Impact Investing the Right Strategy for Charities?

Wednesday 11 February 2026While impact investing offers charities a way to better align capital with the core mission, investing in these markets requires clear definitions of risk tolerance, setting realistic expectations, and careful management of additional risks involved.

Read moreWill the MPC cut Bank Rate in March 2026?

Wednesday 11 February 2026The MPC left Bank Rate at 3.75% on the 5th of February, but a surprise 5–4 vote prompted markets to sharply increase expectations of a March cut. Four members backed an immediate reduction, signalling a clear shift towards easing, while updated forecasts show weaker growth and inflation returning to target sooner than expected.

Read moreTime to Revisit Housing Company Structures?

Tuesday 10 February 2026Recent changes to PWLB policy and the HRA threshold send a clear signal that government now expects councils to deliver social housing directly, on balance sheet, and at lower cost. With discounted HRA borrowing extended to 2027 and regulatory barriers materially reduced, many authorities should urgently reassess whether housing company structures still represent value for money in today’s policy and funding environment.

Read moreWhat is Causing the LA-to-LA Liquidity Squeeze?

Monday 09 February 2026As year-end approaches, an LA-LA squeeze is pushing inter-authority borrowing rates higher, narrowing the cost advantage over PWLB and reinforcing the importance of flexible liquidity planning and diversified funding options.

Read morePolice and Fire Authorities: Are They Different from Other Local Authorities?

Friday 06 February 2026Police and fire authorities are not simply smaller local authorities. Their narrow functions, constrained funding, and evolving governance models create distinct financial and treasury priorities, increasingly shaped by devolution and reform.

Read moreAre ESG Issues Impacting UK Commercial Property?

Thursday 05 February 2026UK commercial property continues to offer long-term income, but sustainability is becoming a growing source of differentiation. Energy efficiency and environmental risk are starting to influence resilience, particularly in offices, with impacts varying across other sectors. Over time, these factors may shape asset quality and capital requirements more than near-term pricing.

Read moreIs the latest government housing package a game changer?

Thursday 05 February 2026Government ministers have unveiled a long-term housing package offering rent certainty, £39 billion of funding and ultra-cheap loans, alongside regulatory breathing space. Promising on paper, but major delivery pressures around safety, retrofit and new supply could still undermine the decade of renewal.

Read moreWhat Do Shifts in the International Order Mean for Global Finance?

Wednesday 04 February 2026US political volatility and growing use of economic coercion may accelerate a shift towards a more fragmented, multipolar financial system. Trade and investment ties could weaken over time, de-dollarisation may gradually advance, and markets may face higher risk premiums, volatility, and rising sovereign borrowing costs.

Read moreShould You Worry About the First US Bank Failure of 2026?

Tuesday 03 February 2026The first US bank failure of 2026 may have passed with little attention, but it is a timely warning that financial strains are still surfacing beneath the surface, reinforcing the need for proactive credit due diligence in treasury management.

Read moreAre Treasury Teams Ready for Local Government Reorganisation?

Tuesday 03 February 2026Local government reorganisation creates immediate treasury risks that go well beyond strategy, from liquidity access and banking mandates to system readiness and retained expertise. This insight shares practical lessons from officers already through LGR, highlighting what treasury teams must prioritise to ensure a stable and compliant Day One.

Read moreHow to Value Shares in a Private Company?

Wednesday 21 January 2026Private company share valuations can be difficult, but they matter. With no market price to rely on, you need a fair value that is credible, evidenced, and defensible, not guesswork. This short guide explains the key valuation methods, when to use them, and how to produce an audit-ready result.

Read moreWhat are the Investment Options and Strategies Available to Charities?

Thursday 15 January 2026Charities face a balancing act between yield, liquidity and security when investing cash reserves. This article outlines practical options across the curve, from bank deposits and money market funds to Treasury Bills and high-quality bonds, and explains how diversification and maturity ladders can strengthen outcomes.

Read moreWhat Are the Treasury Risks Facing Housing Associations?

Monday 12 January 2026Treasury risk in housing associations is often viewed as settled, but some exposures receive more attention than others. Interest rates, liquidity timing, covenant headroom, security capacity and refinancing pressures interact over time, shaping resilience and highlighting why long-term financial planning assumptions matter.

Read moreHow divided is the Monetary Policy Committee?

Wednesday 07 January 2026A finely split MPC, newly transparent voting rationales and a policy rate edging towards neutral mean the next phase of UK interest rate decisions will be driven less by the headline vote and more by where individual members truly sit on inflation and demand risks.

Read moreAre Universities Managing the Wrong Treasury Risks?

Monday 05 January 2026As UK universities enter 2026, the balance of treasury risk has shifted. Interest rate risk remains important, but greater pressures now sit in liquidity timing, income volatility, counterparty concentration and funding resilience, pointing to the need for a reset of treasury risk frameworks.

Read moreDo Section 114 Notices Indicate Credit Risk?

Tuesday 23 December 2025A section 114 notice signals acute financial pressure but also demonstrates the strength of the local government financial framework. Statutory controls, governance and central support materially limit lender risk, shifting the focus from credit risk to evidencing robust, auditable due diligence.

Read moreWhy Use iDealTrade? 10 Key Benefits of the Platform

Monday 22 December 2025iDealTrade is a secure, low-cost platform that automates local authority to local authority lending, replacing voice brokers with efficient trade matching and embedded market intelligence to support cost-effective local-to-local financing.

Read moreAre UK (Private) Financial Markets Safe?

Wednesday 17 December 2025The Bank of England has launched its second System-Wide Exploratory Scenario, examining risks in private equity and private credit markets. Rapid growth, limited transparency and strong links to the UK economy raise questions over systemic risk, regulation and future financing conditions.

Read moreHow to measure local authority creditworthiness?

Tuesday 16 December 2025UK local authorities remain highly creditworthy. Arlingclose’s Financial Strength Scores offer a transparent, data-driven framework to distinguish relative strength across the sector, supporting proportionate, well-evidenced treasury decisions aligned with the CIPFA Treasury Management Code requirements.

Read moreWhat are the Changes in the Further & Higher Education Statement of Recommended Practice (FEHE SORP)?

Monday 15 December 2025This insight summarises the 2026 FEHE SORP, highlighting major changes to strategic reporting, income recognition, lease accounting and development expenditure.

Read moreWhat is the future of QE and QT in the US and UK?

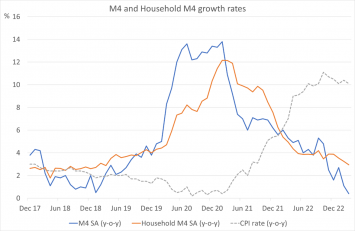

Friday 12 December 2025This insight explains quantitative easing and quantitative tightening, outlining how they operate and why they matter for interest rates, liquidity and financial conditions. It compares US and UK experiences since 2008 and considers the implications of ongoing balance sheet reduction for money markets and government bond yields.

Read moreWhy was the UK sovereign rating affirmed?

Thursday 11 December 2025Moody’s affirmed the UK’s sovereign long-term rating with a stable outlook, citing strong institutions and balanced fiscal risks, while medium-term prospects improve through planned policies, investment reforms and potential gains from innovation and EU relations.

Read moreWhat does the Budget mean for Charities?

Wednesday 10 December 2025What does the Autumn Budget mean for charities as limited government and individual support, frozen tax thresholds, rising costs, and income pressures combine to create a tougher financial environment that requires stronger planning and disciplined investment?

Read moreHow Will the Budget Affect Housing Associations?

Thursday 04 December 2025The 2025 Budget introduces new funding channels, planning reforms, welfare changes and long-term rent policy that will influence housing association finances, raising questions about scale of opportunities that may now be opening.

Read moreWhat Treasury Strategies Do I Need to Prepare?

Tuesday 02 December 2025Local authorities are preparing Capital, Treasury and Non Treasury Investment Strategies plus MRP or Loans Fund policies. Each outlines borrowing, investment parameters, risk, limits and long term plans, providing a clear narrative of the authority’s financial position and future direction.

Read moreWhat will Markets be watching in the Budget?

Friday 21 November 2025An overview of key Autumn Statement scenarios and how the government's forthcoming fiscal choices will impact on gilt yields, fiscal credibility and market confidence.

Read moreA Recalibration of English Higher Education

Thursday 20 November 2025The Post-16 Education and Skills White Paper reshapes English higher education, linking funding & governance to quality & specialisation.

Read moreWhat does the new FSCS Limit mean?

Wednesday 19 November 2025The planned increase in FSCS deposit protection to £120,000 from December 2025 reflects regulatory efforts to maintain confidence in the financial system. The change restores the real value of cover, updates limits for temporary high balances, and prompts consumers and treasury professionals to reassess how deposits are distributed across authorised firms.

Read moreWhat are the changes to the Charities Statement of Recommended Practice (SORP)?

Friday 14 November 2025The Charity Commission’s updated SORP introduces a new three-tier reporting structure, revised lease accounting aligned with FRS 102, and enhanced ESG disclosures. Effective from 1st January 2026, charities must assess forecast income, review leases, and prepare systems and policies to ensure compliance and transparency under the updated framework.

Read moreParish Council Borrowing

Thursday 13 November 2025Parish and town councils must secure borrowing approval before applying for funding, typically from the PWLB. With rates now around 4–6%, assessing affordability, project viability and alternative funding options is more important than ever.

Read moreHow Does Adjustment-A Impact Local Government Reorganisation?

Friday 07 November 2025Local government reorganisation requires resolving historic technical finance adjustments such as Adjustment-A, ensuring fair treatment of inherited debt and CFR balances, to avoid uneven revenue impacts and enable new authorities to begin with prudent, equitable debt repayment positions.

Read moreWill Bank Rate Be Cut in November?

Tuesday 04 November 2025Arlingclose expects a UK Bank Rate cut in Q4 2025, with easing inflation, a softer labour market and fiscal tightening strengthening the case. A November move is unlikely, but momentum for December is growing, signalling lower rates ahead for 2026.

Read moreFunding Strategy Options for Local Authorities

Wednesday 29 October 2025With borrowing costs elevated and liquidity under pressure, local authorities must adopt a strategic, forward-looking approach. Current conditions highlight the importance of active treasury management, cash flow planning, diversified funding, and scenario analysis to strengthen financial resilience.

Read moreDoes the UK (and its Treasury) Have a Productivity Problem?

Friday 24 October 2025The UK faces a persistent productivity slowdown driven by weak investment, poor multi-factor productivity, and Brexit-related frictions. This stagnation now constrains growth, narrows fiscal headroom, and shapes the Treasury’s decision-making, with direct consequences for markets, politics, and your institution’s budget.

Read moreIs There an AI Stock Market Bubble?

Thursday 23 October 2025The rise of Artificial Intelligence has fuelled warnings of a new technology-driven market bubble. However strong corporate balance sheets, equity financing and moderate valuations suggest this is more a ripple than a repeat of history’s bubbles.

Read moreHow Resilient Are Universities to Tightening Liquidity?

Thursday 16 October 2025Universities face mounting financial pressure as rising borrowing costs, falling overseas income, and eroded domestic fees strain budgets. Liquidity and surpluses are declining, forcing institutions to tighten spending, delay projects, and rely on short-term credit to maintain financial stability.

Read moreIs Treasury Management the Hidden Message in the 2025 Charity Risk Assessment?

Wednesday 08 October 2025The Charity Commission's 2025 Risk Assessment warns that financial resilience is the sector's key challenges as costs rise and demand surges. In this climate, sound treasury management and governance are essential.

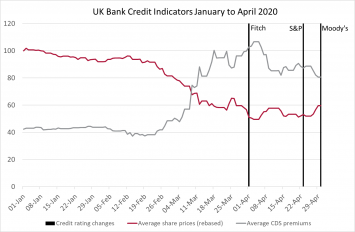

Read moreHow Do Credit Ratings and CDS Spreads Help Us Assess Creditworthiness?

Tuesday 07 October 2025Assessing creditworthiness is fundamental to sound treasury and investment management. Two primary tools used for this purpose are credit ratings and credit default swaps - each offering distinct but complementary insights into credit risk.

Read moreWhat to Expect in the Autumn Budget?

Friday 03 October 2025November’s Budget comes against a backdrop of weak growth, sticky inflation and stretched public finances, leaving the Chancellor with little room to manoeuvre. Markets will be looking for fiscal discipline and credible plans, while limited tax levers raise tough questions about whether manifesto pledges can hold.

Read moreWhat Does the US Government Shutdown Mean for the Economy?

Thursday 02 October 2025Congress’s failure to pass a full-year spending bill has triggered a US government shutdown. While debt servicing continues, a prolonged shutdown alongside slowing jobs growth, high deficits and shifting yield curves risks undermining confidence, growth and monetary policy timing.

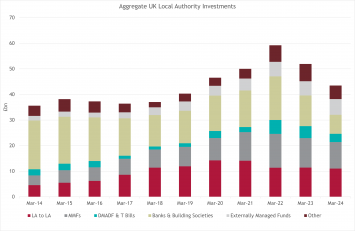

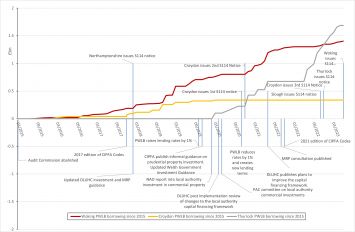

Read moreThe Rise of LA-to-LA Lending

Wednesday 01 October 2025UK local authority investment has shifted markedly over the past decade, with LA-to-LA lending emerging as a core feature of treasury portfolios. Since 2014, volumes have more than doubled from under £5bn to over £12bn in 2025, now accounting for over 30% of the £41.3bn invested. This growth reflects the decline in bank and building society deposits and the appeal of LA-to-LA deals, offering flexibility, competitive rates, simplicity and strong security.

Read moreContractor Due Diligence

Wednesday 01 October 2025UK contractor ISG entered administration on 20th September, underscoring the ongoing risks in the construction sector and the vital importance of thorough due diligence.

Read moreWhat Happened in the Hammersmith and Fulham Interest Rate Swap Case?

Friday 26 September 2025The Hammersmith and Fulham swaps case redefined local authority risk-taking, banning derivatives for decades. With the general power of competence, councils can now prudently use swaps for risk management and savings.

Read moreThe Global Trade Slowdown and Its Impact on Growth

Monday 15 September 2025Global trade is no longer driving growth as it once did, while fiscal and monetary policy options are limited. Without a major boost from productivity or innovation, both the UK and US face a period of weak economic growth and the risk of stagnation.

Read moreTreasury Management for Charities

Wednesday 10 September 2025UK charities face volatile income, rising costs and growing demand. Effective treasury management is essential to protect assets and sustain missions. Arlingclose provides tailored advice on liquidity, investments and debt to strengthen resilience and ensure funds work harder for beneficiaries.

Read moreThe UK Municipal Bonds Agency: Did it Make a Difference?

Monday 01 September 2025The UK Municipal Bonds Agency set out to offer local authorities cheaper and more flexible borrowing, but struggled to compete with the PWLB’s simplicity and pricing.

Read morePreparing for Local Government Reorganisation

Thursday 21 August 2025Local Government Reorganisation creates major treasury challenges in debt, investments, reserves and operations. Without early planning, risks of disputes, delays and misstatements grow. This insight shares Arlingclose’s best practice for reorganisation, ensuring councils achieve resilient, compliant and sustainable treasury arrangements through a smooth financial transition.

Read moreGMCA Ruling Underscores Subsidy Control Risks in Council Lending

Wednesday 13 August 2025GMCA has won a landmark Subsidy Control Act case over two major development loans. Most authorities lack GMCA’s scale or track record, and without independent market evidence as set out in the Statutory Guidance, the same approach could leave your authority exposed.

Read moreIs Financial Repression Coming Back?

Monday 11 August 2025This article examines the potential resurgence of financial repression as a tool for managing high sovereign debt, analysing historical precedents, current policy trends, and risks, while outlining implications for interest rates, banking, fiscal sustainability, and macro-financial forecasting.

Read moreMedium Term Note Programmes: A Flexible Tool for Borrowing at Scale

Wednesday 06 August 2025A Flexible Tool for Borrowing at Scale

Read moreHow to Reduce Financial Risk in Major Projects?

Tuesday 29 July 2025Persistently high insolvencies underline elevated risks for councils and corporates involved in lending or investment decisions. Arlingclose provides robust, independent due diligence, combining detailed financial analysis and practical safeguards for better informed decisions and risk mitigation.

Read moreWhat is the 'Graph of Doom'?

Monday 21 July 2025The ‘Graph of Doom’ illustrates how rising statutory care costs and constrained council income could eliminate funding for discretionary services. Though not a prediction, it highlights the urgent need to address local government’s long-term structural funding challenges.

Read moreHow Will Increased Defence Spending Impact the UK Economy?

Thursday 17 July 2025NATO's new defence spending target of 5% of GDP poses significant fiscal challenges for the UK, highlighting tensions between military ambitions, fiscal rules, and economic realities.

Read moreHow Do You Apply Capital Receipts to Reduce Your MRP Charge?

Friday 04 July 2025Using capital receipts to reduce the Capital Financing Requirement can lower future Minimum Revenue Provision charges, but authorities must apply this approach prudently, consistently, and transparently through their approved MRP policy.

Read moreLocal Authority Investment Trends in 2025

Thursday 03 July 2025MHCLG’s March 2025 data shows local authority investments fell 5% year-on-year to £41.3bn, continuing a post-pandemic decline. This highlights a shift in treasury priorities in response to financial pressures and evolving market conditions.

Read moreActively Managed ETFs

Wednesday 02 July 2025Active ETFs combine traditional active management with ETF efficiency, offering daily liquidity and lower costs than mutual funds. Though nascent in the UK, they present a compelling option for institutional investors. (Part 5 of the ETF insight series)

Read moreAre UK financial markets safe?

Monday 30 June 2025The BoE's first system-wide exploratory scenario (SWES) exercise highlighted how market shocks can be worsened by firm actions; Arlingclose helps clients navigate these risks with tailored advice and lower-risk investment solutions.

Read moreKey Elements of an Effective Treasury Management Strategy

Friday 27 June 2025A Treasury Management Strategy outlines how an organisation manages cashflows, investments, and debt while mitigating financial risks. This article explains key components such as objectives, risk frameworks, investment and borrowing approaches, and highlights the need for governance, regular review, and tailored financial planning.

Read moreHow to Value a Company

Thursday 26 June 2025Valuing private companies is complex due to the absence of market prices. This article explores key valuation methods: DCF, Net Asset Value, and earnings multiples - highlighting their suitability, limitations, and application. Arlingclose offers robust, tailored valuation services grounded in financial and sector expertise.

Read moreHave we really entered a post-pandemic era of higher policy rates?

Wednesday 25 June 2025UK inflation eased slightly to 3.4% in May, but remains above target, with mixed price pressures persisting. Despite global rate cuts, the Bank of England is expected to proceed cautiously, given economic fragility, core inflation, and labour market concerns.

Read moreValuation of Financial Assets in UK Pension Funds

Tuesday 24 June 2025Valuing financial assets in UK pension funds needs a consistent and verifiable approach.

Read moreLOBO Loans: Endgame in Sight

Tuesday 24 June 2025LOBO loans are nearing resolution, with councils now holding the advantage. Most risks have been removed, and remaining exposures offer little threat. Authorities should remain patient, rejecting poor-value offers and awaiting better terms.

Read moreRevisiting Interest Rate Swaps: Five-Years on!

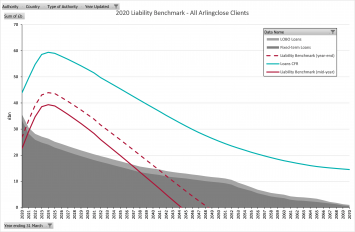

Monday 23 June 2025A local authority interest rate swap arranged by Arlingclose in 2020 has delivered £7.7 million in savings and holds a £30.5 million mark-to-market value as at March 2025. Amid ongoing PWLB volatility, swaps offer lower rates, budget certainty and flexibility. Arlingclose continues to lead in delivering compliant, risk-managed derivative solutions tailored to local authority treasury objectives.

Read moreEMI Client Funds: Keeping Compliant

Tuesday 10 June 2025How EMIs can safeguard client funds effectively, while staying compliant and unlocking better returns.

Read moreWhat to expect in the Spending Review 2025

Monday 09 June 2025The 2025 Spending Review, set to be unveiled by Chancellor Rachel Reeves, outlines £86 billion for R&D and significant boosts to healthcare, education, and infrastructure, balanced by tighter departmental budgets. Defence spending rises to 2.5% of GDP, while local authorities face fiscal strain despite increased allocations, prompting potential council tax hikes and structural reforms to enhance local autonomy.

Read moreThe Hidden Risks of LOBO Restructuring Deals

Friday 23 May 2025A wave of LOBO restructuring proposals is being pushed as attractive, but many are based on flawed assumptions and hidden costs - independent advice is essential before proceeding with any deal.

Read moreBond Buybacks

Monday 19 May 2025As market conditions shift, bond buybacks are emerging as a smart strategy to cut costs, simplify debt management, and boost financial flexibility.

Read moreTreasury Management for Universities

Thursday 08 May 2025Universities face mounting financial pressures from deficits, volatile cash flows, and capital projects. Effective treasury management, encompassing cash flow forecasting, liquidity planning, short-term investment, credit facilities, debt review, and risk hedging, is crucial. Arlingclose supports universities with tailored strategies to enhance resilience, manage risk, and align financial operations with strategic objectives.

Read moreWhy Are Secured Deposits Safer Than Bank Accounts?

Wednesday 07 May 2025Why Now Is the Time to Secure Your Deposits; As Credit Default Swaps Rise, So Does the Risk.

Read moreTreasury Risk Management Approaches

Monday 28 April 2025Effective treasury management requires a balanced approach to risk, recognising that not all risks can or should be avoided. Organisations must evaluate and manage risks within their strategic framework and risk appetite. By setting measurable KPIs and adopting appropriate mitigation strategies, treasury teams can manage financial and operational risks holistically, safeguarding value while enabling opportunities for growth.

Read moreArlingclose Treasury Services

Tuesday 22 April 2025Arlingclose is known for advising local authorities, but our services span far wider. We support charities, housing associations, EMIs, pension funds, and private firms with investment strategy, credit analysis, regulatory compliance, and debt restructuring. Our deep market knowledge, risk expertise and cross-sector experience enable us to deliver bespoke, value-adding solutions across a broad spectrum of financial challenges.

Read moreArlingclose Expands Capabilities Through Strategic Partnership with LiquidityEdge

Thursday 03 April 2025Arlingclose x Liquidity Edge Partnership

Read moreWhat is the Barnett Formula?

Tuesday 01 April 2025The Barnett Formula, introduced in 1978, determines changes in block grants for Scotland, Wales, and Northern Ireland based on population share. While it simplified funding allocation, it faces criticism for lacking transparency and ignoring regional needs. Attempts to reform it, including a needs-based approach, remain unimplemented. Further devolution of tax powers offers alternatives, but no permanent solution has emerged.

Read moreCan the Spring Statement Solve the UK’s Twin Deficits?

Wednesday 26 March 2025With fiscal headroom shrinking and structural trade imbalances deepening, today’s Spring Statement raises a critical question: can the UK escape the grip of its twin deficits?

Read moreInvesting in ETFs (Part 4)

Thursday 20 March 2025Global equity ETFs provide diversification, but their compositions can differ significantly. Despite similar names, ETFs vary in regional, sectoral, and company exposure. Investors should analyse holdings, sector weightings, and subtle fund name distinctions to ensure alignment with their strategies. Conducting due diligence is crucial for informed investment decisions.

Read moreWhat Are the Best Joint Venture Structures for Housing Associations and Local Authorities?

Wednesday 19 March 2025The right joint venture structure can unlock funding, minimise risk, and accelerate housing delivery; find out which option best supports your development ambitions.

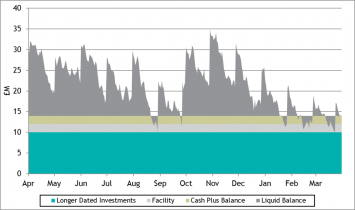

Read moreDebt Strategy and Liquidity

Wednesday 19 March 2025Inter-LA lending rates have surged, and shifting PWLB dynamics are reshaping borrowing decisions; our latest insight explores how a balanced debt strategy can help local authorities navigate market volatility and secure cost certainty.

Read moreWhat are the Difficult Parts of Year-End Accounting?

Wednesday 19 March 2025As year-end approaches, local authorities must tackle complex financial reporting challenges beyond IFRS 16. This insight explores key accounting areas, including financial instruments, capital adjustments, debt restructuring, and non-SPPI loans. Understanding these nuances ensures compliance, accuracy, and avoids costly errors. With expertise in these areas, Arlingclose can support your closedown process and financial reporting requirements.

Read moreHow Can Innovative Lending Facilities Support Housing Associations?

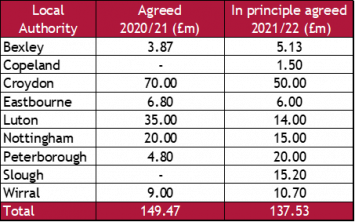

Tuesday 18 March 2025Arlingclose has arranged over £500 million in lending for housing associations, strengthening local authority funding connections. Our flexible, unsecured revolving credit facilities help housing providers manage liquidity efficiently. With £300 million arranged in two years, we support borrowers of all sizes. Meet us at the NHF Finance Conference (19-20 March, Liverpool, Stand 820) to discuss your funding needs.

Read moreHow Will Trump’s Trade Wars Impact the UK Economy?

Tuesday 18 March 2025The Trump administration’s tariffs mark a shift towards protectionism, aiming to reduce the US trade deficit but risking inflation, slower growth, and global retaliation. Trade imbalances stem from deeper economic factors, limiting tariffs' effectiveness. Rising costs could complicate Federal Reserve policy, while global uncertainty and weaker demand may impact UK exports and inflation despite limited direct exposure.

Read moreWhat is Third in the Fair Value Hierarchy?

Monday 03 March 2025IFRS 13 establishes a fair value hierarchy for financial instruments: Level 1 (quoted market prices), Level 2 (observable inputs), and Level 3 (unobservable inputs). Most instruments fall under Levels 1 or 2, but valuing Level 3 assets, like non-traded shares, is complex. Arlingclose assists local authorities with expert valuation methodologies and disclosures for accurate financial reporting.

Read moreWhy Have Some Fund Managers Exited Climate Initiatives?

Thursday 27 February 2025The Net Zero Asset Managers (NZAM) initiative, launched in 2020 to drive climate-aligned investing, faces challenges as major firms exit amid political and regulatory shifts. NZAM has suspended activities and is reviewing its framework. Concerns over ESG scrutiny have led to "greenhushing," where firms downplay sustainability efforts. Regulatory rollbacks in the U.S. and EU add to uncertainties in responsible investing.

Read moreWill the US withdraw from Multi-lateral Development Banks? – Credit Market Implications

Tuesday 25 February 2025President Trump’s executive order to exit select UN bodies and review US participation in global institutions raises credit market uncertainty. Rating agencies warn MDB downgrades are possible if US support declines. While immediate impacts are limited, investors should watch US policy, MDB ratings, and bond spreads.

Read moreTransferring Temporary Accommodation Units from the General Fund to the Housing Revenue Account

Tuesday 25 February 2025This insight explores the potential transfer of temporary accommodation from the General Fund (GF) to the Housing Revenue Account (HRA) to improve financial management for local authorities in England. It examines the legislative framework, including the Local Government and Housing Act 1989, potential benefits, challenges, and the process involved in such transfers.

Read moreWhere does your data go?

Monday 24 February 2025Local authorities’ financial data reporting is crucial for monitoring expenditure, assessing risks, and informing economic planning. MHCLG, OBR, ONS, and HM Treasury use this data for GDP estimates, fiscal forecasts, and funding allocations. It impacts tax capacity, borrowing limits, and financial stability. Accurate reporting ensures transparency, effective resource allocation, and sound public financial management across the UK.

Read moreWhy ECLs are Even More Important This Year

Thursday 20 February 2025Expected Credit Loss (ECL) is an accounting charge for potential investment losses under IFRS 9. New MRP guidance (May 2024) requires ECL charges for capital loans, impacting council tax. While treasury investments face minimal ECLs, auditors will scrutinise higher-risk service-related loans.

Read moreTrump 47: Disinflation or Disruption?

Tuesday 11 February 2025It has been 22 days since Trump was inaugurated as the 47th President, and his early policy moves on energy, regulation, monetary policy and trade could have significant implications for inflation, interest rates and the UK economy.

Read morePaying a Living Wage

Tuesday 11 February 2025Arlingclose is a Living Wage Employer, ensuring all staff, including apprentices and interns, are paid fairly as part of our ongoing commitment to social responsibility and fair employment practices.

Read moreCombined Authorities: A Growing Trend in Local Governance

Monday 27 January 2025Combined Authorities are transforming UK local governance by promoting regional collaboration on transport, housing, and economic growth. The government's devolution agenda aims to expand their role, but challenges include balancing local representation, managing costs, and ensuring transparency. Effective leadership and strategic planning are key to their long-term success.

Read moreHow to Prepare for IFRS 16

Friday 17 January 2025IFRS 16 requires most leases to be recognised on the balance sheet, impacting prudential indicators and financial reporting. Arlingclose offers expert support to simplify the transition, ensuring compliance and accurate financial impact assessment for councils adopting IFRS 16.

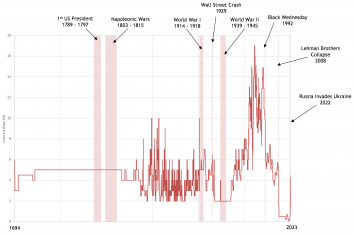

Read moreRisks to the Financial Sector in 2025

Thursday 16 January 2025The UK financial system has experienced notable disruptions every 17 years since 1974, including the Secondary Banking Crisis (1974), the collapse of BCCI (1991), and the global financial crisis (2008).

Read morePublic-Private Partnerships: Helping Local Authorities Exit Legacy Agreements

Friday 10 January 2025UK local authorities are reassessing costly and inflexible Public-Private Partnerships (PPPs) to address fiscal pressures, with successful examples like Greater Manchester saving £20 million annually through renegotiation. Careful planning, expert advice, and stakeholder engagement are essential for councils to optimize resources and enhance service delivery.

Read moreFrance Economic Weakness

Friday 27 December 2024France faces a period of profound political and economic instability, marked by rapid government turnover, rising bond spreads, and waning investor confidence. While short-term risks remain contained, sustained political fragmentation could undermine fiscal stability and market trust.

Read moreConnecting British and American Yields

Thursday 05 December 2024UK gilt yields closely track US Treasury yields due to shared monetary policies and global factors, with recent political and economic developments suggesting continued correlation, particularly at longer maturities.

Read moreBond Buyback for Birmingham City Council

Wednesday 20 November 2024Arlingclose has successfully supported Birmingham City Council in repurchasing £73m of its 9.675% bonds due 2030, replacing them with £88m of new funding from the Public Works Loan Board at an average rate of 4.6%. The refinancing is projected to save £2.8m over five years, significantly reducing interest costs while maintaining a similar repayment profile.

Read moreScottish Local Authority Investment Balances

Tuesday 19 November 2024Scottish local authorities' investment balances dropped 20% to £2.4 billion over 12 months to September 2024, outpacing the UK-wide 11% decline, driven by rising expenditure, reserve use, and reduced long-term borrowing. Amid tighter liquidity and 5.5% short-term loan rates, councils face seasonal cash flow pressures but are leveraging higher rates for investment opportunities through proactive financial management.

Read moreWhat are gilts and why do their yields matter for UK local authorities?

Tuesday 29 October 2024Look into UK government bonds, or gilts, including their origin, types, and market dynamics, and the inverse relationship between prices and yields. Explore the impact of gilt yields on borrowing costs for UK local authorities and see how economic and political events drive yield volatility, affecting public sector financing.

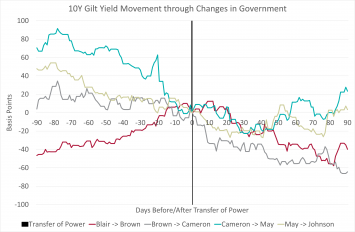

Read moreTrump vs Harris: Implications for UK Gilts

Thursday 24 October 2024Discover how the upcoming US election could impact UK borrowing costs.

Read moreHow Do I Capitalise Interest Costs?

Tuesday 22 October 2024How capitalising interest costs can lead to significant savings for your authority, and ensure compliance with accounting policies.

Read moreLocal Authority Borrowing Option – National Wealth Fund

Wednesday 16 October 2024The UK Infrastructure Bank has become the National Wealth Fund, now operating with a broader mandate and increased capital. It remains a competitive source of finance for local authority infrastructure projects, particularly those targeting climate change and sustainability goals.

Read moreStay Ahead of The Curve

Thursday 10 October 2024Learn how yield curves play a crucial role in financial analysis and interest rate forecasting, offering valuable insights for smarter treasury management and decision-making in your local authority.

Read moreSupporting Housing Associations Through Local Authority Lending Facilities

Wednesday 09 October 2024Discover how Arlingclose's tailored local authority funding solutions are empowering housing associations.

Read moreHow to Conduct Due Diligence on a Local Authority?

Friday 04 October 2024Discover the key challenges of conducting due diligence on local authorities and how expert analysis can simplify your investment decisions.

Read moreThe Benefits of Capitalising Interest Costs During the Construction of an Asset

Friday 04 October 2024Discover how capitalising interest costs during asset construction can enhance financial performance, improve asset valuation, and support long-term financial strategy for local authorities.

Read moreInvesting in ETFs (Part 3)

Thursday 03 October 2024There is a range of income-focused ETFs, from steady dividend payers to high-yield bonds, tailored to suit varying risk appetites and investment goals.

Read morePSNCR and the Seasonality of Local Authority Borrowing

Friday 27 September 2024Discover how seasonal borrowing trends impact local authorities and learn strategies to manage year-end cash flow challenges effectively.

Read moreIs it time to review your MRP Policy?

Wednesday 18 September 2024With significant changes on the horizon, this insight highlights immediate actions that could unlock both short and long-term financial benefits before the new MRP Guidance takes effect in April 2025.

Read moreWhat is the FSCS and is My Authority Covered?

Tuesday 17 September 2024Find out if the FSCS could protect your authority's deposits and whether your investments are fully covered.

Read moreThe Rise of Company Insolvencies in England and Wales

Friday 13 September 2024Company insolvencies in England and Wales reached record levels in 2024, surpassing the 2008 financial crisis, due to inflation, rising interest rates, and post-pandemic economic pressures. This surge highlights financial strain across key sectors like retail and hospitality, leading to higher unemployment and increased financial risks.

Read moreWhat Time to Email the PWLB

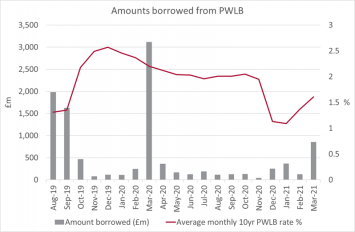

Monday 09 September 2024Fixed loan rates are set twice daily and are influenced by gilt yields, which fluctuate throughout the day. Borrowers should carefully monitor these yields to decide whether to borrow in the morning or afternoon, as afternoon rates may be lower. However, waiting carries the risk of overnight market changes, which could lead to higher rates the next day

Read moreThe Rise and Fall of Credit Suisse

Friday 06 September 2024Credit Suisse, once a global banking powerhouse with a huge market capitalization, collapsed in 2023 after years of scandals and mismanagement, ultimately being acquired by UBS.

Read moreAre UK Financial Markets Safe?

Tuesday 03 September 2024The Bank of England's SWES exercise reveals that severe market stress could lead to significant liquidity needs for non-bank financial institutions, tightening conditions in the repo market, and increased pressure on corporate bond markets.

Read moreThe Management of Legacy Debt

Monday 02 September 2024Legacy debt funds in the UK were created to manage debts from abolished local councils, ensuring financial obligations are met and shared among successor authorities, despite the councils' dissolution.

Read moreExceptional Financial Support & Capitalisation Directions Explained

Thursday 29 August 2024What is the difference between Exceptional Financial Support & Capitalisation Directions?

Read moreIs Your Financial Assistance Compliant?

Tuesday 13 August 2024Learn how to ensure your authority's financial assistance to local businesses aligns with market standards and avoids legal challenges.

Read moreAre you ready if an inspector calls?

Wednesday 31 July 2024Without additional government support many authorities will struggle to make ends meet over the next few years, but those that can demonstrate good governance may have a more sympathetic response from stakeholders if an inspector ever calls. In this latest Insight David Blake explores this process and how a review of treasury management practices can help reduce and control risk.

Read moreSupranational Bonds: A Secure and Sustainable Investment Opportunity

Wednesday 17 July 2024Amid high yields and rising ESG investing, supranational bank bonds are highly attractive. Issued by entities like the World Bank, these AAA-rated bonds offer high security, liquidity, and diversification, often yielding higher returns than sovereign debt. Despite potential risks, they provide secure, strong-return, and socially responsible investment options.

Read moreThe Ministry Formerly Known As …

Tuesday 16 July 2024The staff at DLUHC (Department for Levelling Up, Housing and Communities) will once again be ordering some new headed notepaper and changing the sign on the door on the news that the department has, on 9th July 2024, been renamed MHCLG (Ministry of Housing, Communities and Local Government).

Read moreThe Future of Public Finance: Trends and Predictions for H2 2024

Thursday 11 July 2024As we move into the second half of 2024, several emerging trends are set to shape the landscape of public finance. What are they?

Read moreRevisiting Interest Rate Swaps

Wednesday 10 July 2024Arlingclose played a pivotal role in advising and executing a swap for a local authority in 2020, providing substantial savings.

Read moreHave you refreshed your TMPs recently?

Wednesday 10 July 2024How up to date are your Treasury Management Practices (TMPs), an important document encapsulating your Authority’s treasury ‘principles’ and ‘schedules’?

Read moreBest Practice for Managing Local Authority Cashflows

Tuesday 09 July 2024This insight offers practical strategies to enhance local authority cashflow management, ensuring financial stability and efficient resource allocation

Read moreWhat do the MHCLG Live Tables tell us about LA Investment Balances?

Monday 08 July 2024What do the MHCLG Live Tables tell us about the latest changes in local authority investments and how they could affect treasury strategies.

Read moreWhat are the new UK Subsidy Rules?

Monday 08 July 2024The Subsidy Control Act 2022 came into effect on 4th January 2023 replacing EU State Aid rules. This sets out the framework under which local authorities should award subsidies going forward.

Read moreAre Banks more Creditworthy than Local Authorities?

Monday 01 July 2024Recently many financial institutions have had their credit ratings upgraded while local authorities have been downgraded. Are bank deposits becoming more attractive than inter-authority lending for LA treasurers?

Read moreInvesting in ETFs (Part 2)

Monday 24 June 2024How can ETFs provide local authorities with cost-effective and diverse investment opportunities, including ESG-focused options, to fit their investment strategies?

Read moreThe S&P Global UK PMI

Friday 21 June 2024Explore June's UK PMI: What does the latest data reveal about the UK economy.

Read moreIncome Strips Revealed

Thursday 20 June 2024Understand the pros and cons of income strips to effectively manage long-term liabilities and fund essential projects - read this insightful guide now.

Read moreUS Labour Markets: Are There Signs of Recession Ahead?

Thursday 06 June 2024The US labour market's resilience has had a significant impact on global bond markets and interest rate expectations.

Read moreCommon Pitfalls in Your Year End Accounts (and How to Avoid Them)

Wednesday 22 May 2024The end of May is a busy time for local authority accountants, with most authorities aiming to have draft accounts ready by the end of this month. So to help you on your way this year here are some common, yet usually simple to fix, problems that we see.

Read moreGreenwashing and Credit Risk

Tuesday 21 May 2024Discover how Arlingclose's guidance can help you navigate ESG investments and mitigate the risks of greenwashing – ensuring prudent management of public funds.

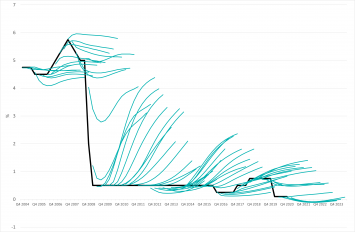

Read moreBank of England to Overhaul Its Forecasting Approach

Tuesday 07 May 2024A major review by former Federal Reserve chairman Ben Bernanke of the Bank of England’s forecasting approach and processes highlighted significant problems and made recommendations for change.

Read moreIs the path of UK inflation more like the US or Eurozone?

Friday 03 May 2024As UK gilt yields rise amidst a global reassessment of monetary policies, our latest analysis provides a perspective on the UK's economic position relative to the US and Eurozone.

Read moreThe FCA’s Anti-Greenwashing Rule

Monday 29 April 2024The UK's Financial Conduct Authority's new anti-greenwashing rule, effective 31st May 2024, offers clear guidelines to ensure sustainability claims are accurate, complete, and transparent, helping local authorities safeguard their ESG investments and make informed financial decisions. What should you be aware of?

Read moreInvesting in ETFs

Friday 19 April 2024With interest rates still elevated, returns from investing in cash will likely remain high in the near-term. However, we continue to believe there remains a case for long-term investing on both an income and capital growth basis, particularly when rates start to decline, and to this end we are currently investigating ETF related options that we believe may benefit our clients.

Read moreIFRS 16 and PFI Schemes

Tuesday 09 April 2024The “new” IFRS 16 Leases accounting standard is finally upon us, with CIPFA/LASAAC confirming that there will be no further delay to implementation beyond 1st April 2024.

Read moreWhat is the PRI?

Thursday 04 April 2024The Principles for Responsible Investment (PRI) is the world’s leading advocate of responsible investment. It works to support the incorporation of environmental, social, and governance factors (ESG) into investment decision-making.

Read moreCan Local Authorities Help Fund Your Housing Association?

Tuesday 12 March 2024Arlingclose has arranged £400m of lending facilities for housing associations and we’d be pleased to discuss funding transactions or any other arrangements between housing associations and local authorities where our experience and knowledge can be applied.

Read moreAssurance with Your Accounts

Tuesday 05 March 2024As all local authority accountants will know the upcoming few months can typically be a busy, and sometimes daunting, time. As our clients will be aware Arlingclose are here to provide assistance with some of the most difficult parts: your financial instruments and capital financing requirement calculations.

Read moreValuing Shares

Tuesday 27 February 2024How do you calculate the fair value of a share? Arlingclose has many years of experience in valuing a wide variety of shares owned by local authorities.

Read moreExpected Credit Loss Calculations

Tuesday 20 February 2024Our tried and tested models enable us to form a reasoned and consistently applied judgement as to how likely a borrower is to default and what impact a default would have on expected future cash flows. We are able to calculate an ECL to stand up to audit scrutiny.

Read moreAre UK Financial Markets Safe?

Wednesday 14 February 2024Last year the Bank announced it was launching its first system-wide exploratory scenario (SWES) exercise to help improve its understanding of how both banks and non-bank financial institutions would behave under severely stressed financial market conditions.

Read moreAre Inflationary Pressures Building?

Thursday 01 February 2024The recent trend of below consensus UK inflation figures had raised hopes for a rapid loosening in monetary policy in 2024, but the ONS inflation data for December 2023 (published in January) made for less pleasant reading.

Read moreFunding Electric Vehicle Fleet Conversions

Tuesday 23 January 2024As the electric vehicle market evolves, a growing number of lessors are prepared to take residual value risk on these assets. Is this an efficient way for local authorities to reduce cost and risk as they migrate towards net zero?

Read moreCapital Flexibilities – A Call for Views

Monday 15 January 2024The government's engagement with local councils on capital resources and borrowing, as announced by the DLUHC, offers fresh perspectives on capital flexibilities and local financial management.

Read moreDifferent Debt Structures

Monday 08 January 2024Understand your options: Learn how maturity, annuity, and EIP loans differ in repayment profiles and risk, offering valuable insights for effective financial management.

Read moreThe UK's Unique Local Authority

Friday 05 January 2024The City of London Corporation is the governing body for the City of London, a small area in Central London that is the traditional home of finance services in the UK.

Read moreTriple Bottom Line Reporting

Tuesday 02 January 2024TBL reporting is a framework that goes beyond traditional financial reporting by considering three key dimensions. So what are the perceived benefits of TBL reporting?

Read moreWhat are the FCA’s new Sustainability Disclosure Requirements?

Thursday 14 December 2023Following consultation, on 28th November the Financial Conduct Authority (FCA) released its long-awaited policy framework on Sustainability Disclosure Requirements (SDR) and investment labels.

Read moreTime to Revisit Your MRP?

Thursday 30 November 2023At Arlingclose we believe, as we get into 2024/25 budget setting, there has never been a better time to review your current and future MRP policy.

Read moreThe Outlook for Green Gilts

Monday 27 November 2023Green Gilts, also referred to as Green Bonds, are a type of fixed-income financial instrument. These are issued by government bodies and specifically aim to fund projects tackling climate change, finance infrastructure investment, and create jobs across the country.

Read moreWhat to expect in the Autumn Statement

Thursday 16 November 2023What to expect in the Autumn Statement

Read moreIt's Strategy Time

Tuesday 14 November 2023For a small subsection of local authority accountants (the ones that work in treasury management) now is usually the time of year when minds turn to preparing the annual treasury management and related strategies for their organisation.

Read moreWhat is the UK GfK Consumer Confidence Index?

Wednesday 25 October 2023In June, we shared insights regarding the GfK Consumer Confidence Index, a monthly barometer published in the UK. Building upon that, we now delve deeper into the questions posed by the index and explore the factors that contributed to a shift in sentiment observed in October.

Read moreIncome Strips & Indexed Linked Debt

Tuesday 17 October 2023Local authorities are increasingly being presented with offers for income strip and inflation-linked debt from various institutions. The article explores why some authorities are opting to exit these agreements prematurely.

Read moreCan I Give a Subsidy?

Thursday 12 October 2023There might be scenarios where local authorities find it advantageous to offer loans at sub-market rates to certain companies, or perhaps even extend grants. Is such financial support permissible?

Read moreWhat's going on with Metro Bank?

Wednesday 11 October 2023Metro Bank launched in 2010 and has been among the most well-known of the so-called challenger banks. What has led to a rescue deal being announced?

Read moreWhy Do We Have Two-Tiered Local Government?

Tuesday 03 October 2023Many but not all parts of England have a two-tiered local government structure. Why do we have this structure?

Read moreESG Integration

Monday 02 October 2023In the landscape of finance, the importance of incorporating environmental, social, and governance (ESG) considerations into investment strategies has grown markedly.

Read morePeak Rate Uncertainty

Friday 29 September 2023After nearly two years of upward moves in bond yields and wild levels of volatility, have we achieved peak rates?

Read moreWhich UK House Price Indicator is Best?

Friday 29 September 2023Given that each House Price Index draws on different data and varies in methodology, it’s important to consider a few different HPIs.

Read moreWhat is a Section 5 Report for a Local Authority?

Wednesday 27 September 2023Birmingham City Council’s City Solicitor and Monitoring Officer issued a Section 5 report last week. What is a section 5 report?

Read moreWhat is the UK Money Markets Code?

Tuesday 26 September 2023Developed by the Bank of England, The UK Money Markets Code was first published in 2017 and established high level principles of appropriate standards to ensure trust exists between a diverse set of participants.

Read moreSection 114 notices – who will be next?

Friday 22 September 2023Birmingham City Council is the largest and most high profile of the six local authorities to have issued a section 114 notice since 2018. Perhaps unsurprisingly, there is now some speculation in the national press over who will be next.

Read moreElectric Vehicles, Salary Sacrifice, IFRS 16 and Scotland

Friday 15 September 2023Many climate-conscious employers have taken advantage of a government-backed scheme to provide their staff with electric vehicles.

Read moreSocial Impact Bonds

Thursday 14 September 2023SIBs are a form of partnership in which investors provide upfront funding for a social program where their return on investment is linked to certain predetermined performance targets.

Read moreThe Outlook for UK Commercial Property

Wednesday 13 September 2023The UK's commercial property sector is facing a significant sell-off, investors and asset managers are grappling with the complex task of valuing their portfolios in this shifting landscape.

Read moreWhat does Birmingham City Council’s Section 114 Notice Mean for the Local to Local Lending Market?

Tuesday 12 September 2023The biggest local authority in the country is in financial difficulty, and so it is not unreasonable to ask how this might impact the local-to-local lending market.

Read moreWhy do Section 114 notices happen?

Friday 08 September 2023Why do Section 114 notices happen?

Read moreWhy Local Authorities Really Matter

Wednesday 06 September 2023Aside from administrative functions local authorities are also crucial for some other really important things: like how likely you are to die younger than you should.

Read moreWhy do I have a pension asset?

Wednesday 09 August 2023This year a number of local authorities have a pension asset on their balance sheet rather than a pension liability. What does this pension asset mean in practice and why has this started to occur now?

Read moreWhat is the VIX?

Tuesday 08 August 2023The Cboe Volatility Index – better known by its ticker ‘VIX’, is a financial benchmark devised to act as a live market estimate of the expected volatility of the S&P 500 Index.

Read moreDo Credit Ratings include ESG?

Friday 04 August 2023Credit ratings and ESG ratings are different products. But do ESG risks influence credit ratings and are the main rating agencies building these into their credit assessments?

Read moreEuropean Commission’s assessment of Money Market Funds’ resilience

Wednesday 02 August 2023The European Commission recently published its long-overdue review of Money Market Fund (MMF) regulation in Europe on the adequacy of MMF regulation from a prudential and economic point of view.

Read moreThe First Subsidy Control Regime Judgement

Tuesday 01 August 2023The Competition Appeal Tribunal has made its First Subsidy Control Regime Judgement

Read moreHow Regulators Failed to Stop Local Government Failures

Monday 24 July 2023Section 114 notices used to be a rare occurrence but a handful have been issued in the last two years and it is expected that there will be more to come.

Read moreParish Council Investment Advice

Thursday 20 July 2023With market volatility continuing to fluctuate and short-term interest rates rapidly rising, it may be time to reassess your bank balances and short-term investments for security, liquidity and yield.

Read moreArlingclose Investment Benchmarking June 2023

Tuesday 18 July 2023Another quarterly Arlingclose Investment Benchmarking has rolled around and some dramatic changes are afoot.

Read moreUK Bank Stress Test Results

Thursday 13 July 2023The results of the latest Bank of England stress tests on UK Banks have now been published and are summarised in this insight.

Read moreManaging LOBO Calls

Wednesday 28 June 2023As interest rates rise, an increasing number of local authority LOBO loans are being “called” by lenders. The value of options, and risk relating to these loans, must also be considered when reviewing restructuring or repayment scenarios; you can’t directly compare against a fixed rate loan.

Read moreReduce Risk with Secured Deposits

Tuesday 27 June 2023With a simple signup process, increased security, bail-in exemption and a higher yield to top it off, secured deposits offer a competitive option for investment when looking to shore up unsecured investment balances.

Read moreLow Cost Funding and Interest Rate Risk Management

Tuesday 27 June 2023In April 2020 Arlingclose worked with one of its local authority clients to transact an Interest Rate Swap (Swap) which locked in a rate of 0.56% on £75million of funding for a period of 20 years.

Read morePWLB Reduced HRA Lending Margin

Monday 26 June 2023The PWLB has recently announced a reduction in the margin applied to loans that will be used to fund capital expenditure within the Housing Revenue Account (HRA).

Read moreIs Engagement or Exclusion better for ESG?

Friday 23 June 2023One area that has seen lots of attention is the growth in ESG funds or the incorporation of ESG into existing funds’ strategies and the terms exclusions and engagement are often thrown around in this conversation. But is one better than the other?

Read moreWhy is inflation so persistent?

Wednesday 21 June 2023Is persistent inflation here to stay?

Read moreFinancial problems in Guizhou

Tuesday 20 June 2023Local authorities in other countries can get into financial difficulties too. It’s not just Woking, Thurrock, Slough and Croydon that have been making headlines recently. Guizhou, a region in China, has been in the press over concerns about high debt levels, a likelihood of default and the possibility of a bail-out from the central government in Beijing.

Read moreNew Secured Deposit Service

Monday 19 June 2023We are proud to announce that we have successfully supported the trading of secured deposits in collaboration with the innovative fintech Consort1, along with Clearstream, Standard Chartered Bank, NatWest, Alpha Group, and BankClarity, with Gloucestershire County Council being among the first UK local authorities to utilise the new service.

Read moreWhat’s your opinion of local authority accounts?

Monday 19 June 2023A product of the audit process is for an independent assessment on the financial statements of an organisation to express an opinion on their fairness and compliance with applicable accounting principles, which is given through the auditor’s opinion.

Read moreActive vs Passive Investing?

Thursday 15 June 2023Given the challenge presented by the last few years, are we any closer to settling the perennial active versus passive debate?

Read moreAuditing Local Authority Accounts

Friday 09 June 2023The crisis in the audit of local authority accounts has been widely publicised with the Department for Levelling Up Housing and Communities (DLUHC) currently carrying out an inquiry into the current backlog that exists. What changes could be made?

Read moreAccounting for Fair Value through Other Comprehensive Income

Wednesday 07 June 2023Back in April the IFRS 9 Statutory Override was extended for a further two years. Should the Government and the accounting standard setters apply FVOCI as the way to account for these instruments going forward?

Read moreWhat is the Consumer Confidence Index?

Tuesday 06 June 2023The GfK Consumer Confidence indicator in the UK rose to -27 in May 2023 from -30 in April, improving for the fourth consecutive month. However, the index remained below its long-term average, suggesting that a clear majority of respondents continued to report low confidence, in line with data pointing to falling UK retail sales.

Read moreHow to Implement IFRS 16?

Tuesday 30 May 2023IFRS 16 – Just as you thought it was safe to have a holiday!

Read moreWhat do rising construction costs mean for local authorities?

Friday 26 May 2023The last year has seen one of the highest periods of construction price inflation on record.

Read moreWhat is the Outlook for UK Public Finances?

Thursday 25 May 2023Borrowing reached its highest point in March 2021 before it began to ease over the remainder of the year and through 2022 into 2023. However, recent months have seen this begin to worsen once again as the government is forced to borrow to support energy prices amid the cost-of-living crisis.

Read moreShould You Dollar Cost Average?

Wednesday 24 May 2023Dollar cost averaging is not a strategy for deciding what to invest in; rather, it can help you take the stress out of deciding when to invest. Using it as part of a comprehensive financial plan that includes a diversified mix of asset classes can help track, plan, and reduce risk regardless of what's happening in the market.

Read moreIs ESG Over?

Wednesday 17 May 2023ESG investing is moving from an early phase into something more sophisticated where investors will be challenged to really interrogate what they believe, rather than undertaking a tick box exercise.

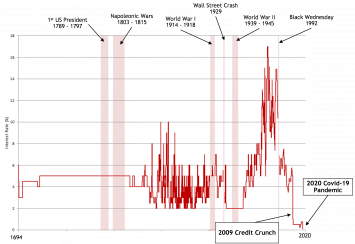

Read moreAn Updated History of Base Rate

Tuesday 16 May 2023Can we expect a return of the sky-high-rates of the 1980s, or a more placid range of about 2% - 6% for the foreseeable future?

Read moreSlower money growth, slower inflation?

Monday 15 May 2023What does easing money growth mean for inflation.

Read moreWhy does the US debt ceiling matter?

Friday 12 May 2023Over the past few years, we've become accustomed to hearing about the political tussles around the US debt ceiling, and the stand-off and brinkmanship to raise its level.

Read moreAre UK Banks Safe?

Wednesday 10 May 2023It’s clear the banking system has been strained in recent weeks, particularly in the US. Can we bank on the banks? (Part 4)

Read moreWhat is the IMF's Outlook for UK Interest Rates?

Friday 14 April 2023IMF suggests a likely return of real interest rates to pre-pandemic levels.

Read moreiDealTrade 10 Best Features - Trade Differently

Tuesday 11 April 2023Need to free-up more time in your day? Perhaps it’s time you made the switch to online trading for your “local to local” transactions. iDealTrade is an online, automated, matching platform for local authority deposits and loans.

Read moreLessons from 30 Years of Attempting to Devolve Power in the UK

Tuesday 04 April 2023A report by the Institute for Government looks at the lessons from 30 years of attempting to devolve power in the UK. It raises some interesting themes and tries to find some practical solutions to this perennial problem.

Read moreImpact Investing

Tuesday 28 March 2023Impact investments are those with strategies that aim to generate both, financial returns and positive, measurable societal or environmental impact.

Read moreHow recently have you reviewed your TMPs?

Thursday 23 March 2023When did you last review your Treasury Management Practices (TMP) document? You may be aware - or even surprised – that it has been a while since you last did so.

Read moreHousing Association Funding Arrangements

Wednesday 15 March 2023Arlingclose secures £400m for housing associations, with flexible solutions tailored to meet unique needs. Discover how we can alleviate your funding challenges, while making a positive impact on society.

Read moreWhat Happened to Silicon Valley Bank?

Monday 13 March 2023Silicon Valley Bank, a specialist US lender to the tech sector, has slumped from being a highly regarded and rated bank to financial failure within a week.

Read moreFair Weather Localism

Tuesday 28 February 2023What are the typical arguments for localism and what needs to be considered?

Read moreBack to Basics: Covered Bonds

Monday 27 February 2023The relative safety and stability of covered bonds compared to other types of bonds may make them an attractive option for investors seeking a relatively safe investment.

Read moreHelp with Your Year End Accounts

Thursday 16 February 2023Arlingclose can provide bespoke assistance where needed with individual aspects of your accounts. Our services includes ECL and Fair Value Calculations, Accounts Assurance, support with preparation, in depth assistance with soft loan accounting, lease accounting, debt restructuring or other notoriously tricky areas.

Read moreThe IMF World Economic Outlook

Thursday 02 February 2023Can the IMF World Economic Outlook Report really be trusted?

Read moreTipping Point?

Wednesday 01 February 2023Like a stereotypical romcom, the global economy appears to be in a will it, won’t it phase. Rather than being romantic entanglement, the subject of this particular situation is, of course, recession.

Read moreCold Weather - Warm Returns?

Friday 06 January 2023As we leave the Christmas period behind us and start the new year, it seems like a good time to reflect on the phenomenon commonly known as the “Santa Claus Rally” and “January Effect”.

Read moreWhen Pubs Replaced Banks

Wednesday 04 January 2023What happened when pubs replaced banks in Ireland in the 1970's

Read moreThe Bonds are Back in Town

Thursday 22 December 2022The historically low interest rates of the last decade have kept many investors out of the fixed income markets. However, in recent months we have seen consecutive interest rate hikes meaning that bond yields are becoming more attractive to investors once again.

Read moreInflation - Written in the Mars?

Wednesday 21 December 2022An inflation index is a tool used to measure price changes over time in an economy, but what can a Mars Bar tell us?

Read moreThe (Asset) Class of 2022

Tuesday 20 December 2022A summary of asset class performances in the year 2022.

Read moreWhat to Call the PWLB

Wednesday 07 December 2022What is the history of the PWLB lending facility?

Read moreCounterparty Goals

Tuesday 06 December 2022World Cup controversies have raised questions for some treasurers. Arlingclose’s counterparty service has always considered more than just credit ratings.

Read moreDoes Scotland get a Raw Deal on Debt Refinancing?

Wednesday 23 November 2022Over recent years Arlingclose has worked with many authorities on debt refinancing transactions, often involving a premature repayment premium, but resulting in beneficial savings and risk reduction. However, we’ve seen limited activity in Scotland due to the different rules on accounting for premiums.

Read moreService Concession Flexibility

Tuesday 22 November 2022The Scottish Government has introduced flexible accounting arrangements for local authorities that are the grantor in service concession arrangements, including private finance initiative and similar schemes.

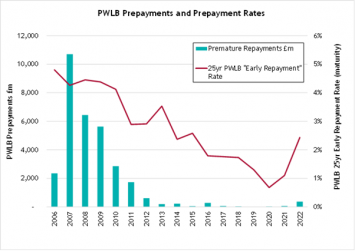

Read morePre-paying Debt to the PWLB

Thursday 10 November 2022Pre-paying debt to the PWLB could lead to savings, if done correctly

Read moreFCA Proposes Rules for Sustainable Funds to Tackle Greenwashing

Wednesday 09 November 2022The Financial Conduct Authority (FCA) has launched a consultation on proposed measures to clamp down on “greenwashing” of investment funds and products.

Read moreThe Bankruptcy of Detroit: Part 3

Tuesday 08 November 2022In the final part of our series we ask why it almost certainly wouldn't happen here?

Read moreThe Bankruptcy of Detroit: Part 2

Tuesday 01 November 2022In the second of a three part series we ask how can a whole city go bankrupt?

Read moreThe Bankruptcy of Detroit: Part 1

Tuesday 25 October 2022Put Your Hands Up for Detroit. In the first of a three part series we look at the USA’s largest ever municipal bankruptcy.

Read morePWLB Certainty Rate Has Changed a Lot

Thursday 13 October 2022PWLB Rates have increased, but the scale and speed of the increase has shocked most borrowers

Read moreThe Customer is Always Right

Tuesday 27 September 2022The Government’s customer when it comes to financing is the capital markets. We’re currently witnessing a rather significant rerating of the customer’s expectations with regard to the price of the product on offer.

Read moreA Change in Policy

Wednesday 21 September 2022Are rate hikes necessary to tame inflation or are monetary policymakers getting carried away?

Read moreCracking the Code(s of Practice)

Tuesday 20 September 2022Local Authorities will soon be updating their strategy documentation which will need to reflect changes in the CIPFA Prudential and TM Codes

Read moreHow Do ESG Strategies Differ?

Tuesday 13 September 2022ESG investment policies, strategies and approaches aren’t one-size-fits-all.

Read moreFunding in a Volatile Market – A Case Study and 10 Top Tips

Tuesday 13 September 2022How do successful treasury managers navigate current rate volatility and mitigate rising interest costs? In this insight we set out how we have helped one of our London Borough clients achieve a low-cost debt portfolio.

Read moreMulti-Asset Investing and Inflation

Thursday 08 September 2022The ability of multi-asset funds to actively invest across asset classes may offer some help by the fund manager being able to seek out and, hopefully, take advantage of opportunities where those assets can provide a degree of protection and therefore take less of a hit to those all-important returns.

Read moreBig Brother is Watching You

Wednesday 07 September 2022The PWLB is here to stay but the scrutiny it now places on applications for funding has increased. Failure to comply will trigger a number of sanctions which are costly and best avoided.

Read moreHow long will gilt shocks continue?

Tuesday 06 September 2022Is credibility in gilt markets eroding?

Read morePlacing your Truss in the Bank of England

Tuesday 06 September 2022Economic Policies under Truss

Read moreAre Banks Prepared for Climate Change?

Tuesday 23 August 2022The Bank of England tested the UK’s largest banks and insurers on how prepared they are for financial risks caused by climate change.

Read moreThe Glorious 31st

Thursday 11 August 2022If you want to understand your local authority’s financial position which bits of the accounts should you focus on?

Read moreDerive Some Benefits

Thursday 11 August 2022Derivatives don’t appear in many local authority portfolios. Used properly, they are excellent risk management tools, but they can be unfamiliar and a little more complicated. Nonetheless, some local authorities are taking advantage of derivatives indirectly through investments in certain pooled funds.

Read moreA Guarantee of Success?

Tuesday 09 August 2022Some authorities have looked at ways of undertaking planned projects whilst complying with the new rules, and one way of doing this is by obtaining third party loans for their subsidiaries, rather than lending the companies the money themselves.

Read moreTaxing Borrowing?

Thursday 28 July 2022They say everything comes back into fashion and this seems to be the case in terms of the control of local authority capital spend.

Read moreA Roundup of Public Finance Live 2022

Friday 15 July 2022After a long two years of few ‘in real life’ meetings, the Arlingclose team were keen to get in front of clients and non-clients alike, at Public Finance Live 2022.

Read morePolitical Turmoil, Relief and Gilt Yields

Tuesday 12 July 2022Political Turmoil, Relief and Gilt Yields

Read moreFCA moves to widen regulatory remit to ESG Data and Rating Providers

Monday 11 July 2022FCA moves to widen regulatory remit to ESG Data and Rating Providers

Read moreThe penny drops, but will it be sustained?

Tuesday 05 July 2022The penny drops, but will it be sustained?

Read moreInterest Rate Uncertainty and the MPC’s New Member

Friday 01 July 2022Interest Rate Uncertainty and the MPC’s New Member

Read moreRegulators Get Tough on Greenwashing

Thursday 30 June 2022Regulators are stepping up their scrutiny over sustainability claims.

Read moreArlingclose advises on LOBO refinancing for Braintree District Council

Tuesday 21 June 2022Braintree District Council (BDC) has recently completed prepayment of its LOBO loans. The existing debt, running at an average interest rate of 4.7% over 40 years, was replaced using a combination of new funding and existing cash resources.

Read moreCan we bank on the banks? Part 3.

Tuesday 21 June 2022Earlier this month the Bank of England published its first resolvability assessment of major UK banks. The report is part of its Resolvability Assessment Framework which the Bank, as the resolution authority, undertakes to evaluate whether banks can fail in an orderly way.

Read moreMinimum Revenue Provision on Capital Loans

Monday 20 June 2022DLUHC has issued an interim response to its November consultation on MRP.

Read moreWhat are Credit Default Swaps?

Monday 13 June 2022Analysing and assessing the financial strength of an institution, be it a bank, a corporate or a sovereign, requires more than just relying on credit ratings. For some time now Credit Default Swaps (CDS) have been used as an additional indicator of risk alongside other measures.

Read moreArlingclose advises on £73m medium term loan facilities for Optivo Housing Association

Monday 30 May 2022Arlingclose is delighted to have arranged a £73m revolving credit facility for the London-based housing association Optivo, funded by UK local authorities.

Read moreGreen Bonds and Sustainability-Linked Bonds – What’s the Distinction?

Friday 27 May 2022Whether the bond is issued as ‘green’ or ‘sustainability-linked’, the servicing of debt, both coupon payment and principal repayment, remains the responsibility of the issuing entity and thorough credit analysis should not be overlooked.

Read morePotential MMF Regulatory Reform – where are we now?

Monday 16 May 2022A regulatory review is due and we noted last year that further rule changes could be on the horizon, driven by the market stresses experienced in March 2020 with the onset of the Covid-19 pandemic.

Read moreGreat (Capital Market) Expectations

Tuesday 03 May 2022Past performance is not a reliable indicator of future returns, or so goes the ubiquitous statement on much investment-related material. Despite this, past performance is often (always?) used by many investors as at least a general guide to what the future may bring.

Read moreThe only way is up?

Friday 22 April 2022There is no doubt about it, bond yields are under significant pressure. They have relentlessly marched higher, driven by both inflation and monetary policy concerns. So, what has changed? The inflation outlook has been known for some time, so why are yields continuing to price in ever higher premiums?

Read moreiDealTrade - Trading on your Terms

Thursday 07 April 2022One of the key advantages of iDealTrade is that it allows you to be a market maker when you have specific requirements for your funding. A District Council's recent success highlights this.

Read moreFix Now, Loan Later

Wednesday 06 April 2022Notable savings have been achieved through forward starting loans with private lenders

Read moreMRP – Is it time to review what you do?

Monday 14 March 2022The recent consultation to changes in the Minimum Revenue Provision regime in England has now closed and has prompted criticism of some of the more extreme approaches taken by local authorities in terms of MRP policy.

Read moreCryptocurrency Due Diligence