The special relationship between the UK and the US extends across geopolitics, culture, and – crucially for UK local authority borrowing costs – gilt yields. A comparison of bond yields across the maturity spectrum in both countries reveals a strikingly similar trend, particularly since the pandemic. While this alignment is partly expected due to financial globalisation and the widespread inflationary pressures of recent years, the extent of this correlation suggests that entities whose funding costs are related to the UK government’s borrowing costs, such as our local authority clients, are vulnerable to US-influenced developments, which may bode ill if recent US political events lead to a higher inflationary environment. But do UK gilt yields always follow US Treasuries?

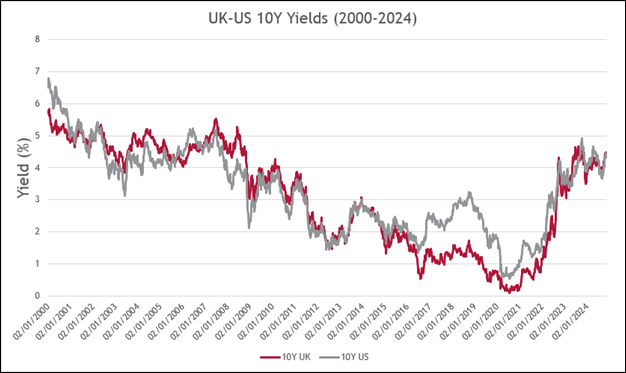

As shown in the graph below, US and UK 10-year bond yields have largely moved in tandem throughout the 2000-2024 period. From 2000 to 2016, yields closely tracked each other, driven by synchronised monetary policies – rising together before the financial crisis, then falling to near-zero rates paired with significant quantitative easing. This close relationship was further reinforced by shared economic conditions, including low inflation and highly integrated global financial markets, where gilts and Treasuries were treated as near substitutes.

However, a notable divergence occurred between 2016 and 2020, driven by monetary policy differences: the Bank of England adopted a more cautious tightening approach following the Brexit referendum, coupled with increased domestic demand for gilts due to Brexit-related uncertainty. This divergence was quickly followed by a sharp convergence, as both countries implemented aggressive measures to support their economies during the pandemic and address the subsequent inflationary pressures. So, there is evidence to suggest that similar yields and yield movements are not a given.

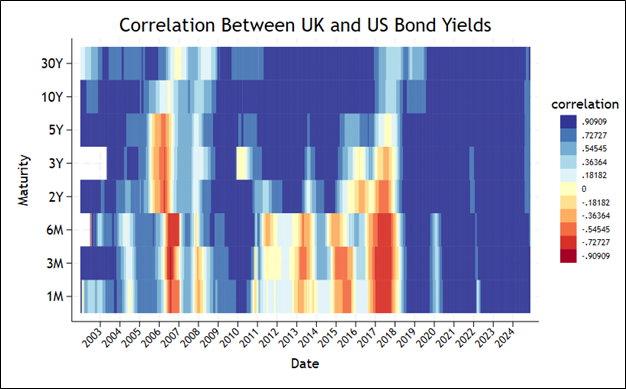

As the matrix shows below, the yield correlation between the UK and the US is remarkably consistent across longer-term maturities. However, short-term gilts and Treasuries display a lower correlation than long-term maturities, as the former are more influenced by domestic monetary policy and short-term liquidity conditions, while the latter are shaped by global factors such as inflation, growth expectations, and similar term premiums across developed economies. However, since mid-2018 – and especially from mid-2020 – Treasuries and gilts of all maturities have exhibited correlations exceeding 90%.

As of November 2024, the BoE and Fed have reduced their benchmark interest rates by 50 and 75 basis points respectively, bringing the BoE rate to 4.75% and the Fed’s target range to 4.50-4.75%. This follows a near-identical tightening policy following the pandemic and a similar time spent on hold at their peaks. Whether gilt and US Treasury yields continue to display high levels of correlation in the future is likely reliant on the ongoing alignment of monetary policies between the two countries. For instance, if the UK were to adopt a more aggressive easing cycle than the US, the pound could depreciate, leading to higher import costs and potentially reintroducing inflationary pressures. On the other hand, a more restrained approach compared to the US could hinder the UK’s growth prospects and reduce the competitiveness of its exports.

Moreover, recent political developments in both countries may have more closely tied the path of rates and yields. While the full ramifications of the UK government’s Autumn Budget and Donald Trump’s victory in the US presidential election will not be apparent for some time, both events have increased concerns about both higher levels of borrowing and potential inflationary outcomes, which could lead to slower monetary policy easing in the UK and US. UK yields across the curve may therefore remain highly correlated with the US over the near term.

Going beyond the UK to assess whether government bond yields in developed economies maintain a close relationship with US movements, we need look no further than Germany and the Eurozone. Germany is projected to grow by only 0.2% in 2024, reflecting ongoing economic challenges, and France’s GDP growth is forecasted to decline to 0.8% in 2025 due to fiscal adjustments. In contrast, the UK government’s fiscal spending plans are projected to help GDP growth rise to between 1.5% and 1.9% in 2025. Unsurprisingly, given the ECB’s leaning towards more significant monetary policy easing as the Eurozone economy slows, the 10-year German Bund is yielding just 2% compared to 4.2% for both UK and US 10-year bonds, with Germany’s significantly flatter yield curve suggesting further expected divergence.

Given the inflationary effects of the UK Autumn Budget and certain policies proposed by Donald Trump, the synchronisation of UK and US yields may continue, although the growth effects of these policies by be more distinct. If this trend continues, local authorities should anticipate gilt yields continuing to dance to a US tune, and potentially remaining relatively high due to the continuing strength of the US economy. However, divergence in yields is possible at the shorter end of the yield curve should respective monetary policies diverge.

If you would like more information on borrowing cost projections or financial forecasting, please contact us at treasury@arlingclose.com or on 08448 808 200.

Related Insights

What are gilts and why do their yields matter for UK local authorities?