As pension funds and other entities seek to match their long-term, inflation-linked liabilities, local authorities have witnessed a rise in the offerings of index-linked borrowing products. One of the most popular of these is the income strip. This insight will explore the advantages and disadvantages of using an income strip structure for borrowing, along with a simplified model to illustrate some of the associated risks.

Income strips are a financing structure in which an investor provides up-front capital typically in exchange for a long-term, inflation-linked, rent. The applications of such structures are diverse, including accessing existing residential or commercial property, providing capital for property development, or addressing other funding needs, such as Glasgow’s equal pay liability.

For example, a Council will “sell” an asset in exchange for a capital receipt and then begins leasing it for a period of 30-50 years, usually paying an inflation-linked rent to the institutional investor. Notably, at the end of the lease, the Council has the option to purchase the property for a negligible amount. It is important to say that not all income strips share identical structures. The measure of inflation used can vary between CPI and RPI, or it can be inflation plus a certain margin, typically 0.5-1.0%. Additionally, income strips often include a ‘floor and cap’ arrangement, where yearly rent increases are subject to minimum and maximum limits, respectively, or may be at a fixed rate.

In the case where an income strip is used to finance the construction of a new property, the structure is attractive as it allows the Council to transfer development risk from themselves to the developer, increases capital efficiency by limiting the upfront capital expenditure, and frequently offers enticing starting rates. Additionally, income strips can be attractive when used to bridge a funding shortfall (such as Glasgow City Council’s deal) when other options are not viable.

When evaluating if an income strip is the optimal financing solution, it should be compared to other available options for the Council. In this context, PWLB lending is used as a benchmark due to its typically low-cost, transparent funding and ease of access.

Cost Comparison:

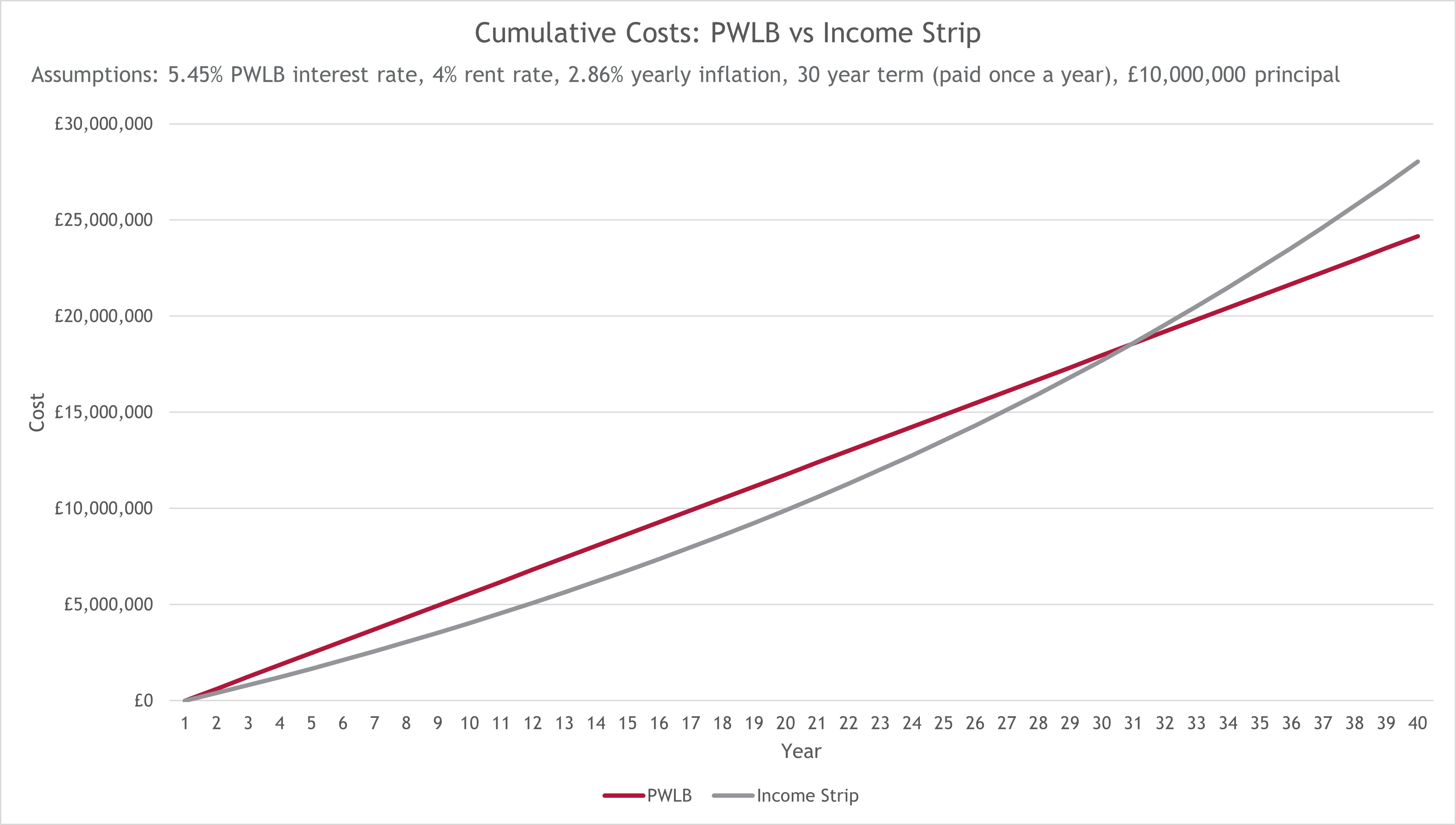

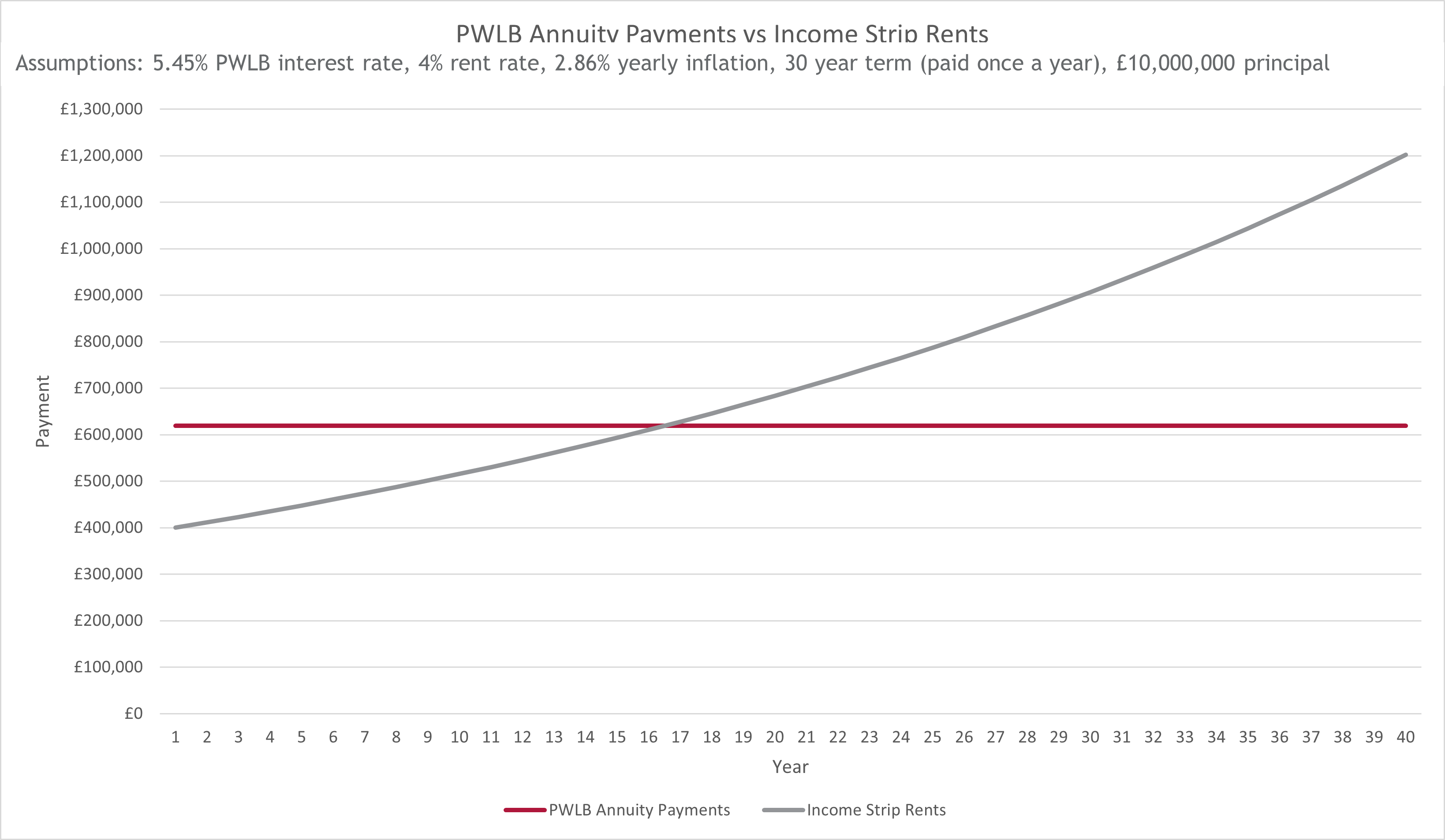

One issue with income strips is their potential to be more expensive than the PWLB alternative over the duration of the deal, even if the initial ‘rent rate’ is lower than the PWLB’s fixed rate. Over time, the cumulative costs between the two options are likely to converge due to the compounding of the inflation-linked rental payments. As illustrated in the first figure below, the cumulative costs of income strips surpass those of the PWLB loan at around the 30-year mark. Similarly, in the second figure, the yearly costs of the income strip exceed those of the PWLB loan at around the 15-year mark.

However, further cost-related risks exist for the Council that are not shown in the model above. Specifically, the assumption that inflation will remain constant and equal to the long-term average makes the income strip appear more attractive than it would be if inflation were to increase above average, even for a limited period. Often the BoE inflation target rate of 2% is used in analysis, however, considering the long lease duration, such an assumption may prove optimistic. Due to compounding, even a brief period of higher-than-expected inflation at the beginning of the loan would significantly impact its cumulative costs.

One must also consider the relationship between inflation-linked rent owed and collected. While rents and other revenue collected by the Council may be expected to increase with inflation, they may not rise at the same rate. Specifically, collected rents might increase less than inflation. This discrepancy could create a deficit that impacts Council finance, requiring coverage from general revenue.

Local authorities should consider the extent of inflation risk and consider whether fixed rate alternatives would be more appropriate.

Accounting Treatment:

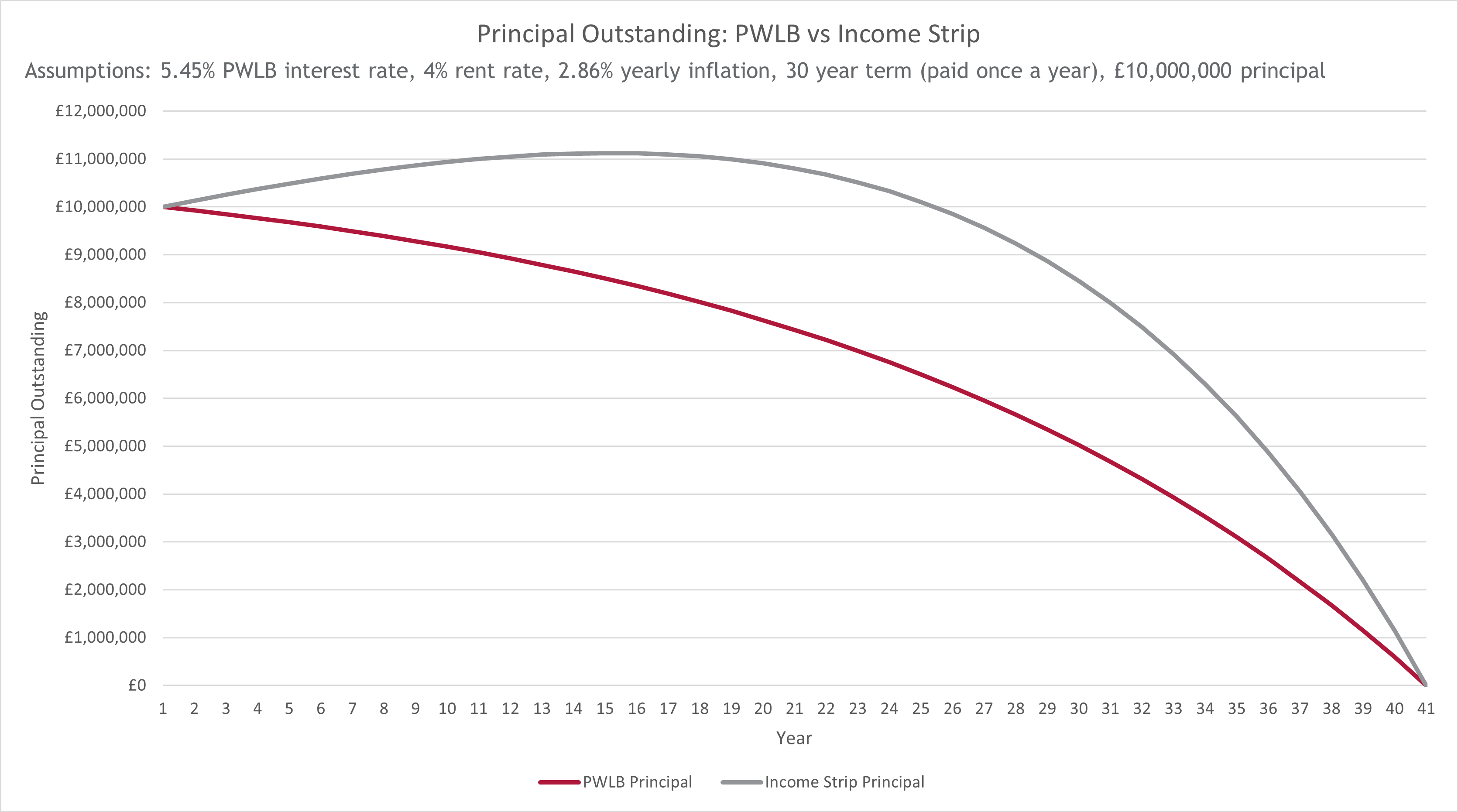

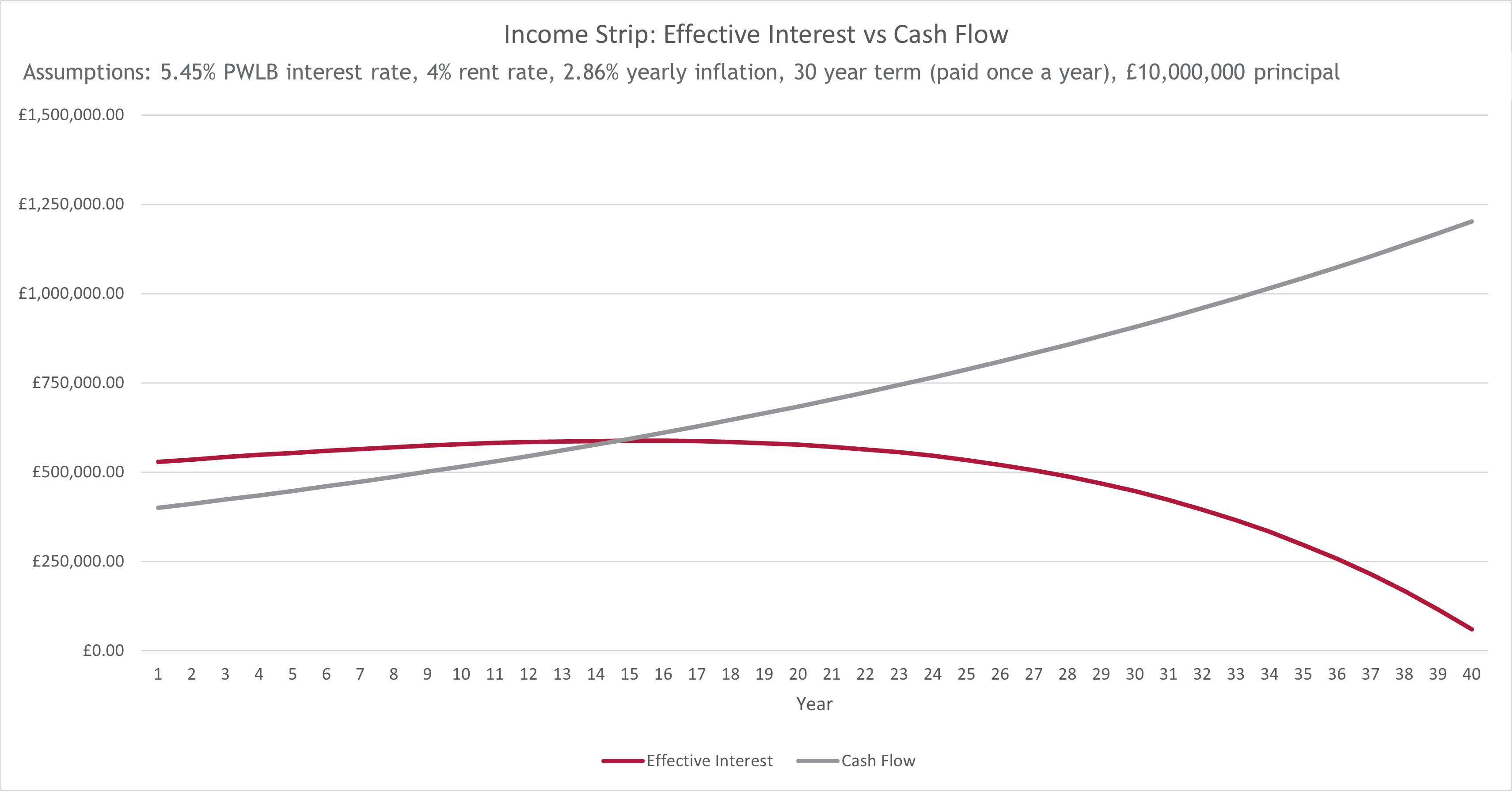

These deals are further complicated by their accounting treatment. Income strip deals may need to be treated like inflation-linked bonds under IFRS 9, which requires accounting for an effective interest rate based on expected inflation and then adjustments to the carrying value for the difference between expected and actual inflation. Alternatively, they may meet the definition of a lease under IFRS 16 with different accounting for inflation. Although there are various ways to account for income strips (all of which are complex and beyond the scope of this insight) the requirement to measure the impact of expected future inflation can be significant. As a result, the effective interest charged to the accounts at the beginning of the deal can be considerably higher than the cash flow on the annual lease payment. This may result in an inflating principal for the beginning portion of the loan, as the liability will need to incorporate the expected increase in inflation, re-measured at each balance sheet date. This could make managing debt and complying with controls, including prudential indicators, more difficult.

Income strips can help authorities raise capital, particularly to invest in “spend to save” schemes, whilst retaining control of key assets. They may also delivery a range of other benefits, linked to the delivery of new infrastructure or services that may not otherwise take place. However, where the products include exposure to inflation authorities will need to consider the risks outlined above and how this is managed. For many, it may be preferable to incorporate fixed rate funding within these structures.

For more information, please contact us at info@arlingclose.com.

Related Insights

Income Strips & Indexed Linked Debt