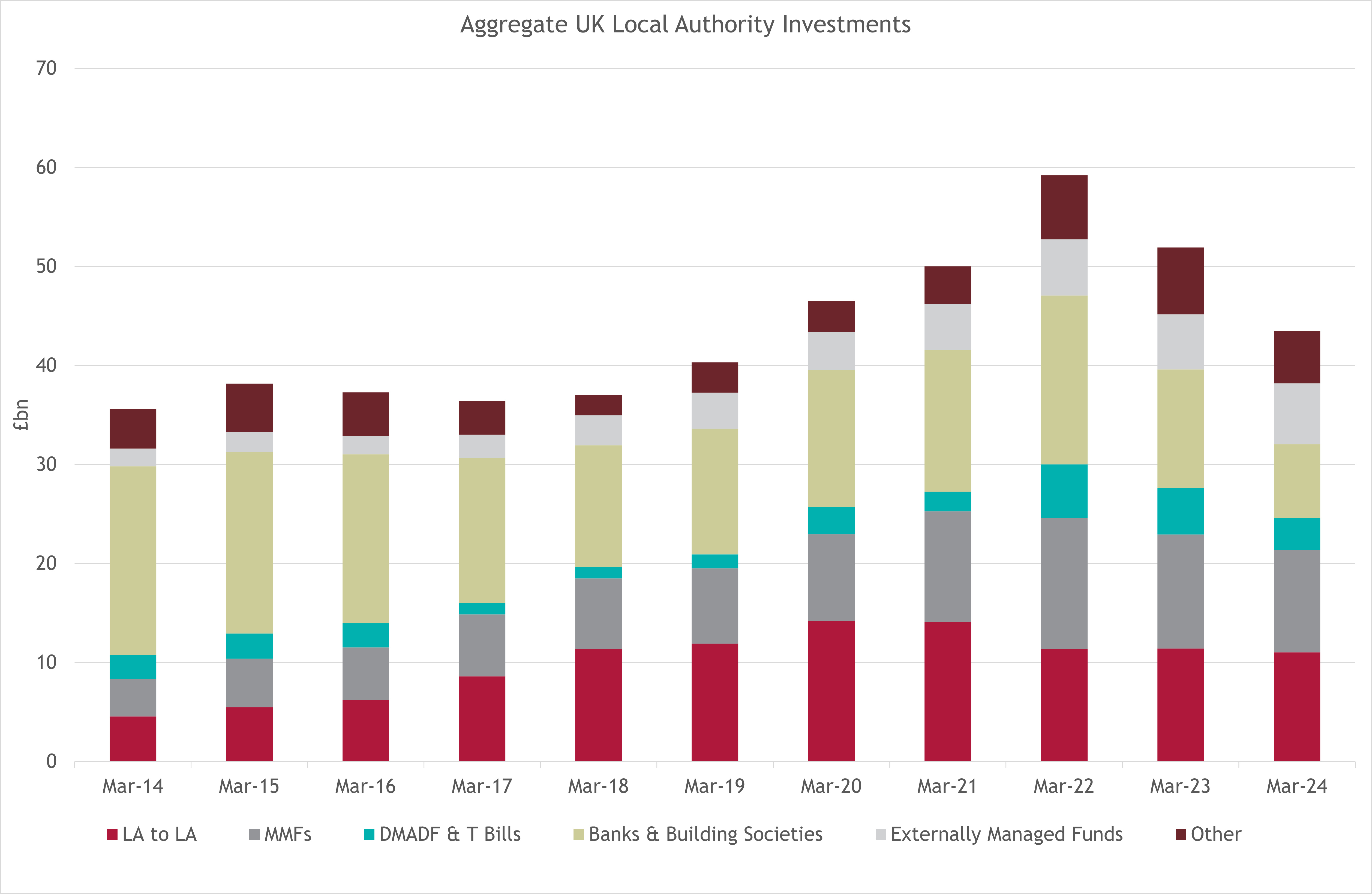

The Ministry of Housing, Communities and Local Government (MHCLG) has updated the Borrowing and Investment Live Tables, providing us with the latest insights into local authority investments as a whole. The MHCLG data is broken down into numerous categories, so for simplicity, we have grouped the data into the sections shown below.

LA-to-LA

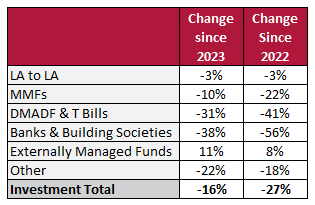

LA-to-LA deals remain a sizeable and sticky portion of portfolios within the sector, having seen only a 3% fall since the aggregate peak in 2022. Local authority deals have risen from £4.5bn in 2014 up to a peak of £14.2bn in 2020. This has seen a slight decline since but has plateaued at £11bn since 2022. There are numerous factors contributing to this, however it is certainly in part because Local Authorities have been offering competitive market rates. As such, there has been a steady number of trades rolled over or replaced with other competitive deals available. As the Bank of England Base Rate has risen dramatically over this period, it is unsurprising the sector has remained competitive.

MMF (Money Market Funds)

Money Market Funds have been utilised extensively to manage liquidity over the course of the last 10 years, increasing from £3.8bn in 2014 to a peak of £13.2bn in 2022. However, a combination of the repayment of assorted COVID grants, and the increase in borrowing costs since 2022, many local authorities have utilised investment balances in lieu of borrowing. This is completely appropriate for many authorities

DMADF (Debt Management Account Deposit Facility) & T-Bills

This area of investment has unsurprisingly declined since 2022. The DMADF rates have been ahead of the curve and offered appealing rates of return, at points in time in excess of both LA-to-LA deals and Money Market Funds alike. Combining this with the Central Government’s hunger for funds in 2022 boosting amounts held in 2022, it is unsurprising to see a 41% decline in balances held with DMADF over the course of the last 2 years.

Banks & Building Societies

This is a positive development for the sector, reflecting prudent treasury management by local authorities. By reducing credit exposure to banks and building societies, local authorities have demonstrated a commitment to the principles of good treasury management: security, liquidity, and yield. Banks have been slower to raise the interest rates offered to investors, leading to a 56% reduction in deposits over two years. This reduction is a natural outcome of the search for better returns and safer investments.

Externally Managed Funds

One of the more difficult areas of local authority investments to assess, because the headline figure held in externally managed funds has increased, however this is likely due to an appreciation in the NAV of funds held, rather than an increase in the principal invested. Despite this, an increase of 8% since 2022.

Other Investments

This section encompasses all the remaining investment types, such as the rest of the world banks, or in some cases supranational bond investments. This has seen a decrease in investment balances largely in line with the general decrease in investment balances.

The Future of LA Investments

What will happen next year when MHCLG publishes fresh data? Well, perhaps a continued decrease of the total investment balances as local authorities utilise investment balances in lieu of borrowing. With an approximate decrease of £10bn each year from 2022, assuming a further £10bn would perhaps seem prudent. This may not tell the whole story, with the Central Government pre-paying numerous grants shortly before March 2024 reporting date thus boosting this figure. Furthermore, the continued higher-for-longer rates from the BoE (Bank of England) will contribute to an increased utilisation of investment balances and reserves. Over the course of the next 12 months, maturating PWLB (Public Works Loan Board) debt will need to be refinanced out of cash or replaced with expensive PWLB debt at high rates, and capital plans will further eat into reserve buffers.

Related Insights

Are Banks more Creditworthy than Local Authorities?