Company insolvencies occur when a business is unable to pay its debts and must either be liquidated or undergo a restructuring process. This can involve selling off assets to repay creditors or entering into agreements to manage debts over time. Insolvency is a critical point for businesses, marking the end of operations in many cases, but it can also be a pathway to recovery for some companies through restructuring.

In England and Wales, company insolvency data is recorded and reported as a group because the two regions share a unified legal system and regulatory framework. The Insolvency Service, which is responsible for collecting and reporting this data, operates under laws that apply across both regions.

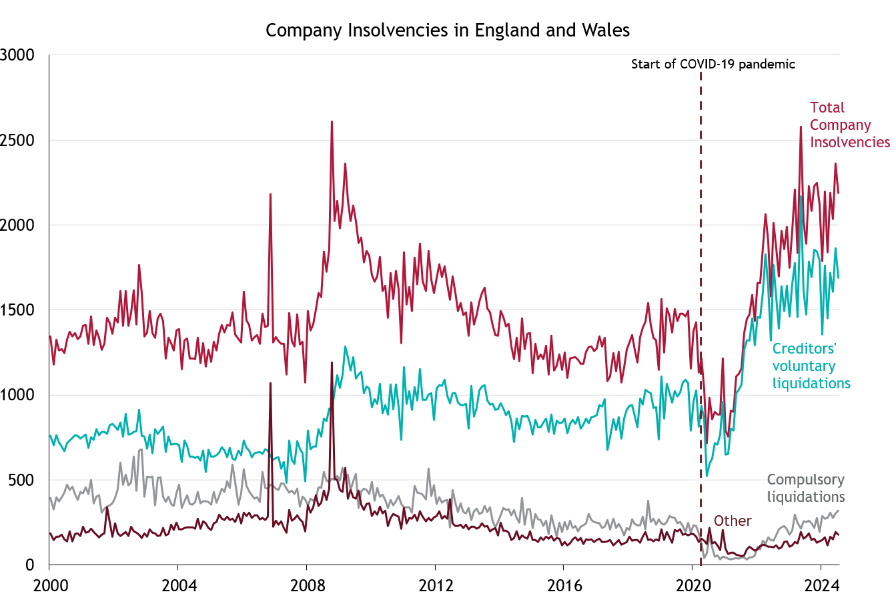

The Insolvency Service in the UK, along with Companies House, regularly publishes data on company insolvencies in England and Wales. These reports categorise insolvencies into different types, such as compulsory liquidations, creditors’ voluntary liquidations (CVLs) and administrations. These figures are adjusted for seasonal variations and compared on a monthly and yearly basis to assess trends.

Compulsory liquidations occur when a court orders a company to be wound up, typically because it cannot pay its debts. Creditors can petition the court to force the company into liquidation, and its assets are sold to repay debts.

Creditors’ voluntary liquidations (CVLs) happen when a company voluntarily decides to close because it cannot pay its debts. The company’s directors initiate the process, but the liquidation is controlled by the creditors, and a liquidator is appointed to sell assets and distribute the proceeds.

Over the past year, company insolvencies in England and Wales surged to record levels, with 25,551 insolvencies recorded in the 12 months leading up to July 2024. This exceeds the peak during the 2008 financial crisis, reflecting severe financial pressures on businesses due to rising borrowing costs, persistent inflation, and ongoing supply chain disruptions. Sectors such as retail, hospitality, and construction have been particularly hard-hit by reduced consumer spending and increased operational costs. While the number of registered companies has grown since 2008, the insolvency rate remains concerning, standing at 56.6 per 10,000 companies, compared to 113.1 per 10,000 during the 2008 crisis.

Sources: Insolvency Service (compulsory liquidations only); Companies House (all other insolvency procedures)

In the chart above, the category labelled "Other" includes various types of insolvency proceedings that don’t fall under the other main categories. These "other" types of insolvency proceedings include:

- Company Voluntary Arrangements (CVAs): A CVA is an agreement between a company and its creditors that allows the company to continue trading while repaying its debts over time, typically at a reduced rate.

- Administration: This is when a company is placed under the control of an administrator (often an insolvency practitioner) with the aim of reorganising the company, selling off assets, or rescuing the business.

- Administrative Receivership: This process involves the appointment of a receiver (usually by a secured creditor, such as a bank) to realise a company's assets to repay secured debts.

At the start of the COVID-19 pandemic, insolvencies initially dropped due to government support measures like the Coronavirus Job Retention Scheme (furlough), business loans, and the temporary suspension of creditor actions. However, from 2021 onwards, insolvencies sharply increased, surpassing pre-pandemic levels as support measures were withdrawn and companies faced mounting debt and financial strain.

The high level of insolvencies in 2024 can be traced to a mix of post-pandemic economic challenges. Businesses are dealing with debt from government-backed loans, the end of support programs, inflation, rising operating costs, and higher interest rates. Supply chain disruptions and shifting consumer demand have also reduced revenue in key sectors. Tighter lending conditions and economic uncertainty have compounded the difficulties, making it harder for companies to secure capital and leading to more insolvencies.

Tracking insolvencies is crucial, as they are a key economic indicator in several areas:

- Employment Impact: Insolvencies lead to job losses, increasing unemployment. Monitoring this trend helps policymakers anticipate and address potential unemployment spikes.

- Financial System Stability: A rise in insolvencies can burden banks and tighten credit conditions, making it essential to monitor trends to manage financial risk.

- Investor Confidence: Increased insolvencies signal heightened risks, particularly in vulnerable sectors, allowing investors to adjust their strategies accordingly.

The UK’s rise in insolvencies mirrors global trends in advanced economies, where many countries are experiencing a post-pandemic surge. While the global economic outlook suggests a potential recovery by 2025, businesses must first navigate the challenging conditions of 2024.

This surge in insolvencies is a critical economic indicator, reflecting both business strain and economic fragility. While it may lead to a more consolidated and stable market in the long term, in the short term, it points to an economic slowdown and rising unemployment, making it a key metric for policymakers and investors.

For further advice on how our interest rate forecasts and reports can support your organisation during uncertain times, please contact us at treasury@arlingclose.com.

Related Insights