Amidst high yields in even the safest fixed-income markets and a surge in socially and environmentally conscious investing, bonds issued by supranational banks have emerged as increasingly attractive investment opportunities. Supranational banks are international institutions that finance development projects in infrastructure, poverty reduction, health, education, and the environment, raising funds from member countries and capital markets to support these initiatives. Examples of such entities include the World Bank, the European Investment Bank, the Inter-American Development Bank, and the Asian Development Bank. With their high credit quality, liquidity, diversification, and alignment with ESG principles, these institutions provide an attractive and sustainable option for enhancing local authority investment portfolios.

Security & Diversification:

A significant benefit provided by supranational bonds is their security. The bonds are typically rated AAA largely due to diversified funding sources, regulatory oversight, high liquidity and international support in times of crisis. The bonds are backed by multiple governments, which must pay capital into the institution if required. Additionally, unlike sovereign fixed income, the effects of country-specific shocks are mitigated through the pan-regional funding structure.

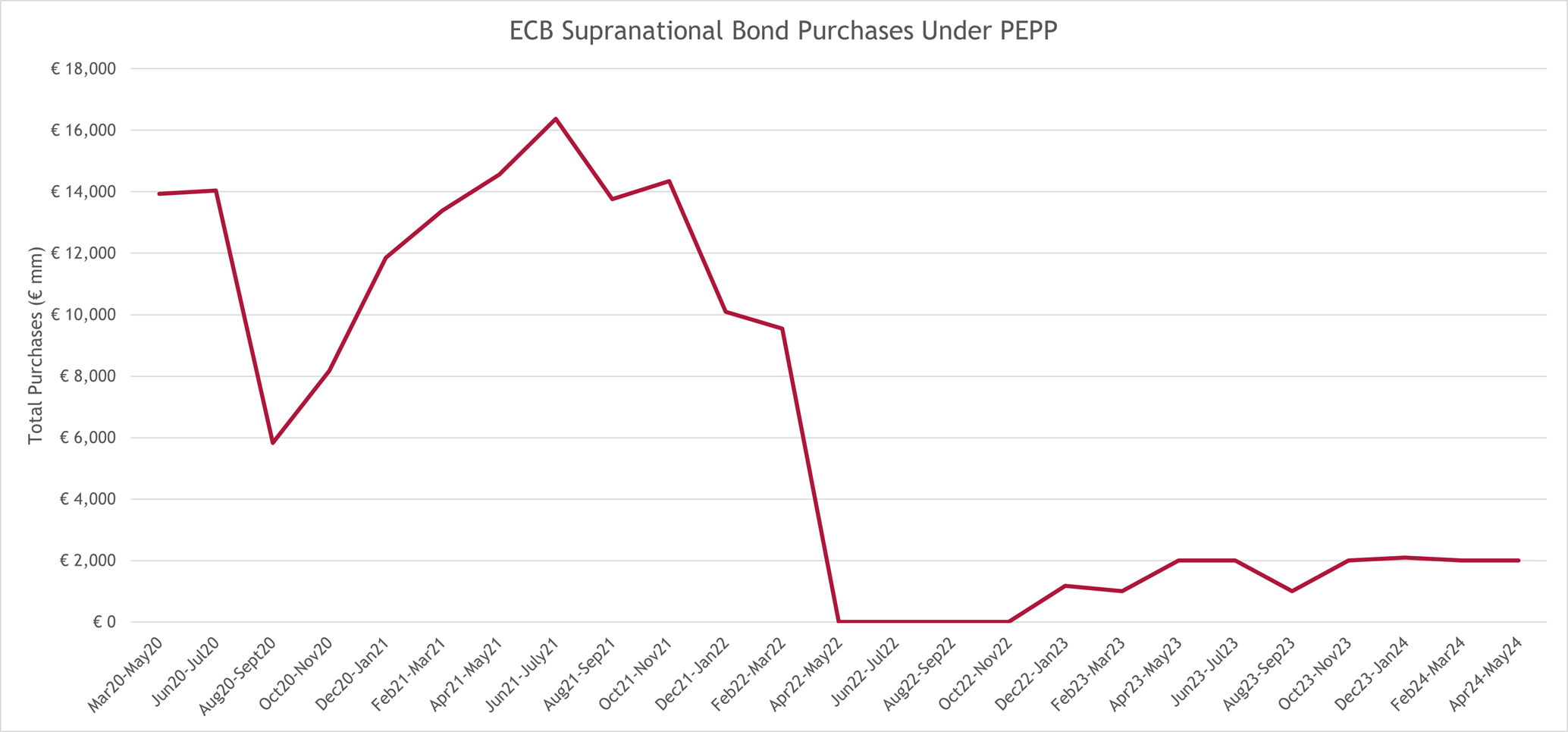

Furthermore, these bonds receive extensive government support in times of crisis and are common targets for quantitative easing strategies, ensuring relative liquidity and price stability. Throughout the pandemic, when markets were experiencing a sudden “flight to safety”, marked by fire sales, increased risk premia and spreads, bonds issued by supranational bonds were often among the first to receive Central Bank support in the form of quantitative easing. For example, when the ECB’s ‘Pandemic Emergency Purchase Programme’ (PEPP) was launched to stabilise markets and support economic activity by maintaining favourable financing conditions, supranational bonds received extensive support.

In total, the ECB purchased over €160bn of supranational bonds which ultimately helped to maintain liquidity, support prices, and prevented heightened borrowing costs for supranational authorities. The critical role of supranational organisations in the global economy and their strong ties to international financial markets ensure that their bonds are among the highest in terms of credit quality. In addition to high credit quality, supranational bonds usually offer higher returns than sovereign debt such as gilts and US treasury bonds.

While supranational bonds offer numerous benefits, they are not without risks. Geopolitical instability, changes in interest rates, and shifts in government policies can impact the performance of these bonds. Additionally, while the high credit quality of these bonds provides a high level of security, investors must remain aware of the potential changes in credit ratings and the economic health of the member countries supporting these institutions.

Investors seeking to enhance their portfolios with secure, strong-return, and socially responsible assets would do well to consider the significant benefits offered by supranational bonds. By balancing their risks with their advantages, supranational bonds can play a crucial role in achieving both financial and social objectives.

For more information or bespoke bond analysis, please contact us at info@arlingclose.com.

Related Insights